This edition of Fincredible breaks down the business of the world's largest luxury conglomerate — LVMH.

We’ll be covering six sections:

The House of LVMH

Crafting Desirabilty

Decentralized Structure

LVMH’s Playbook for Growth

Bernard Arnault & The Russian Dolls

Succession

The House of LVMH: Unveiling the Business Behind the Glamour

LVMH Moët Hennessy Louis Vuitton is the world’s largest luxury conglomerate and is headquartered in Paris. Its a family-owned company headed by Chairman and CEO Bernard Arnault.

With a market cap of $410 billion, LVMH is Europe's 2nd largest company after Novo Nordisk.

The company has a portfolio of 75 luxury brands (or Maisons) organized into 6 business groups — Fashion & Leather, Wines & Spirits, Perfumes & Cosmetics, Watches & Jewellery, Selective Retailing & Other Activities.

These six groups drive LVMH's revenue, each contributing to the company's success in unique ways.

Let's dive deeper into what each of these business groups brings to the table.

1. Fashion & Leather Goods

LVMH’s Fashion & Leather Goods business contributes 49% of the total revenue of LVMH. This business offers a variety of products & services —Ready-To-Wear Clothing, Haute Couture ( custom-made dresses), Leather Goods (like handbags & luggage) and other fashion-related products like shoes, sunglasses, scarves, etc.

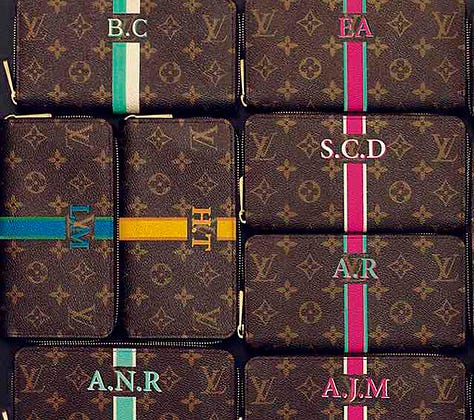

Some of the brands also offer personalization option like embossing or engraving customer’s initials, name, or a message on the product.

Iconic fashion houses like Louis Vuitton, Dior, Celine, Fendi, Givenchy, Loro Piana, and Loewe are included in this segment.

2. Wines & Spirits

LVMH’s Wine & Spirits business has an extensive portfolio of high-quality alcoholic — champagne, fine wine, cognace, whisky & other spirits.

Some brands also earn from subscription services that offer limited-run products, early access to new releases, and private events.

Some of the world’s most prestigious alcohol brands such as Dom Pérignon, Hennessy, Veuve Clicquot, Krug, and Belvedere Vodka are included in this business.

3. Perfumes & Cosmetics

LVMH’s Perfumes & Cosmetics business offers a variety of perfumes, skincare products & cosmetics. Additionally, some of the perfume brands like Guerlain offer luxury spa services using their products, while other brands like Dior offer personal styling services

This business includes brands like Dior Beauty, Guerlain and Givenchy.

4. Watches & Jewelry

LVMH's watches and jewellery business offers watches, a variety of high jewellery and other accessories like charms & cufflinks.

For select high-value clients, brands like Chaumet and Bvlgari, create unique pieces.

Brands in this business include TAG Heuer, Hublot, Bvlgari, and Chaumet.

5. Selective Retailing

LVMH’s DFS (Duty Free Shoppers) Group operates duty-free shops at airports and in popular tourist destinations and offers a variety of products (both LVMH & non-LVMH) across different categories — luxury goods, beaty & cosmetics, liquor & tobacco & luxury confectionery.

Starboard Cruise Services does the same for duty-free shopping on cruise lines.

Sephora is a leading beauty retailer, while Clos19 is a online retail platform for luxury wine and spirits.

This business also include Le Bon Marché and La Samaritaine, which are like luxury department stores.

These stores create luxury shopping experiences, and also offer loyalty benefits to their customers.

6. Other Activities

Hospitality

LVMH’s Other activities business group includes luxury hospitality brands like Cheval Blanc, Belmond Hotels & Bvlgari Hotels & Resorts.

These brands acquire & develop iconic properties in prime locations around the world. Each property is designed to deliver a unique luxury experience.

Media

The Other Activities business also includes media brands like Le Parisien, Les Échos & Connaissance des Arts.

These brands offer high-quality content, many centered on art, fashion, and culture, developed by experienced editors and industry experts. Publications are distributed through both print and digital channels, targeting affluent readers who are passionate about art and luxury.

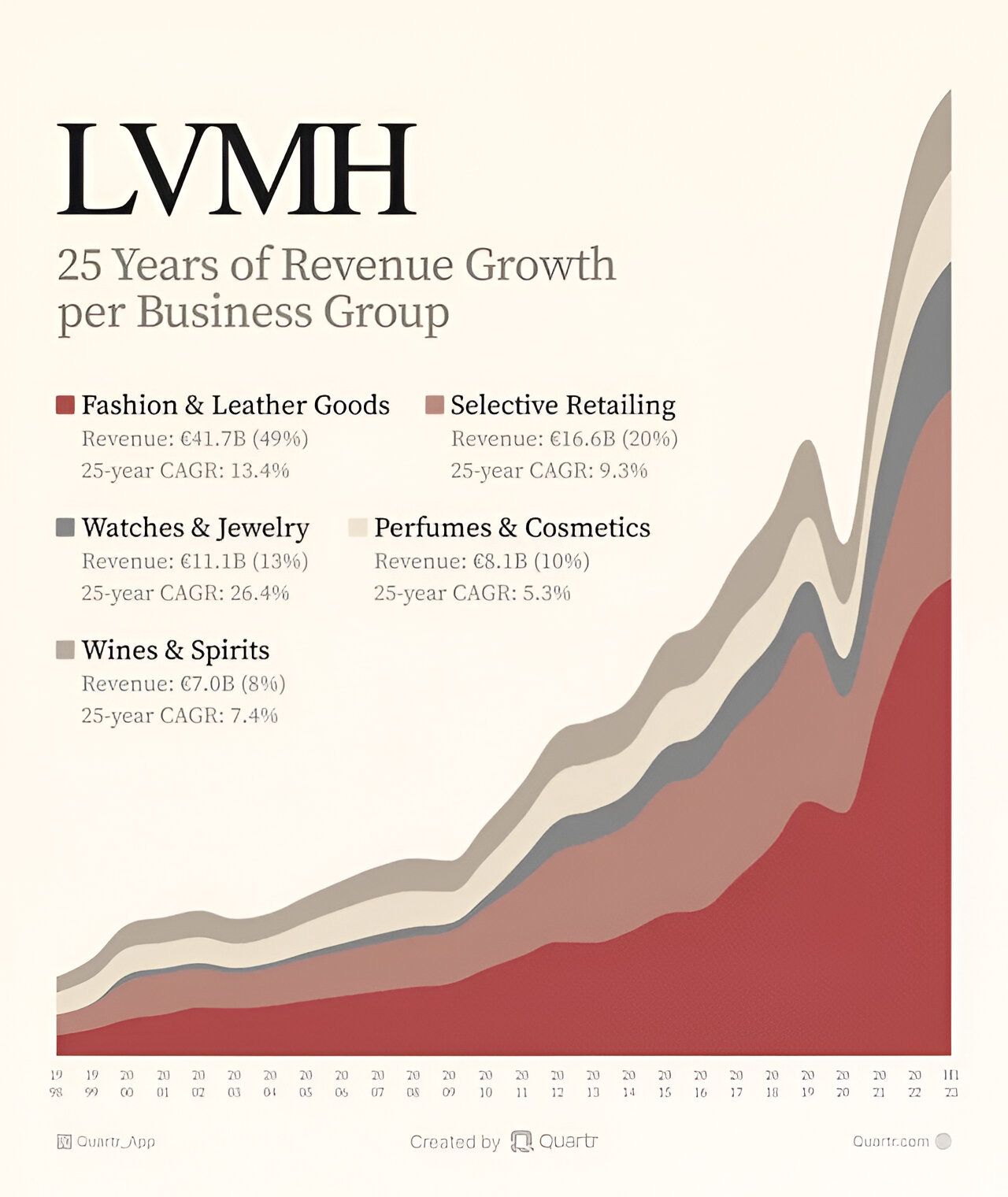

LVMH Revenue Analysis

LVMH ‘s revenue for 2023, stood at 86.2 billion euros. Fashion & Leather was the highest contributing business group, the top performing maisons being Louis Vuitton,

Christian Dior & Celine, which gained market share worldwide

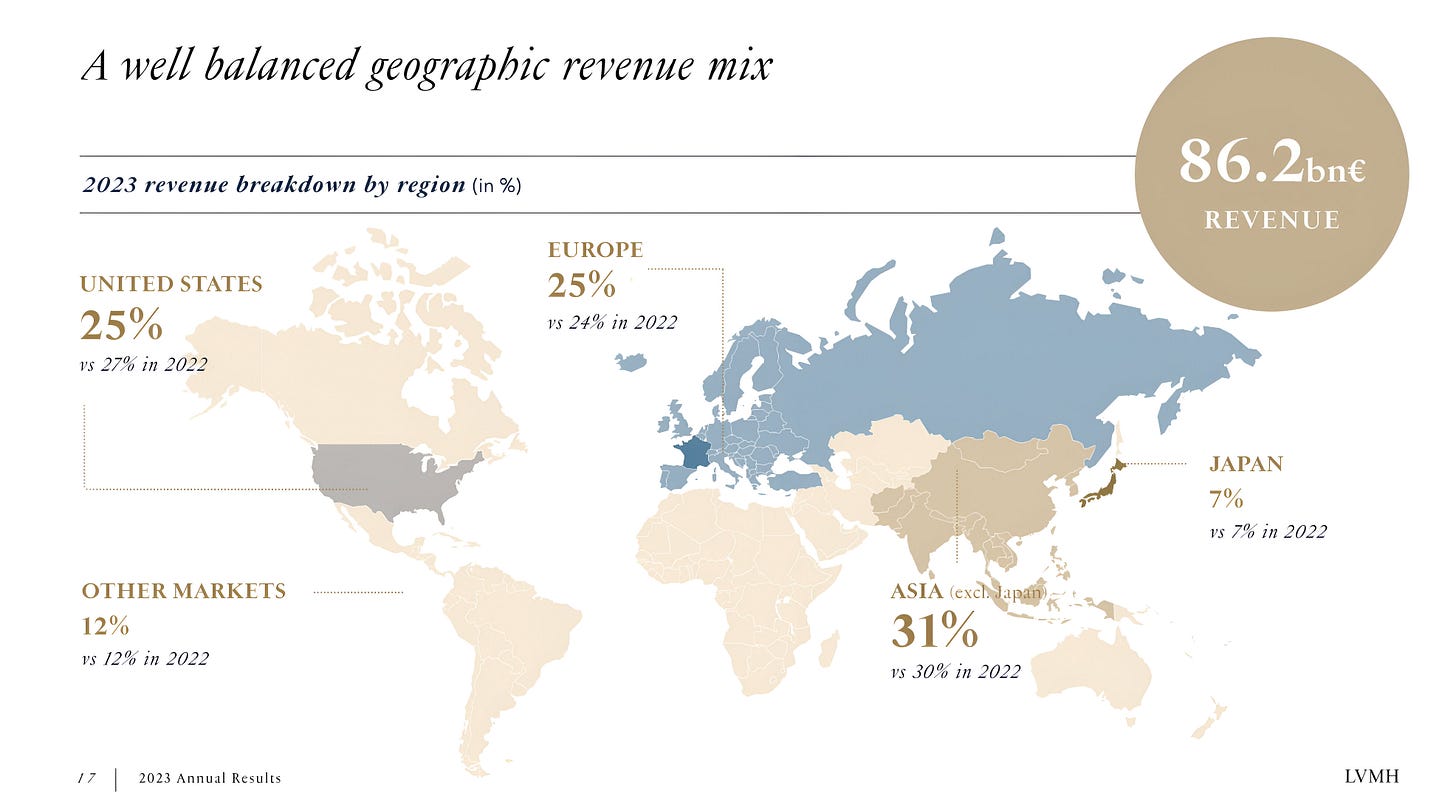

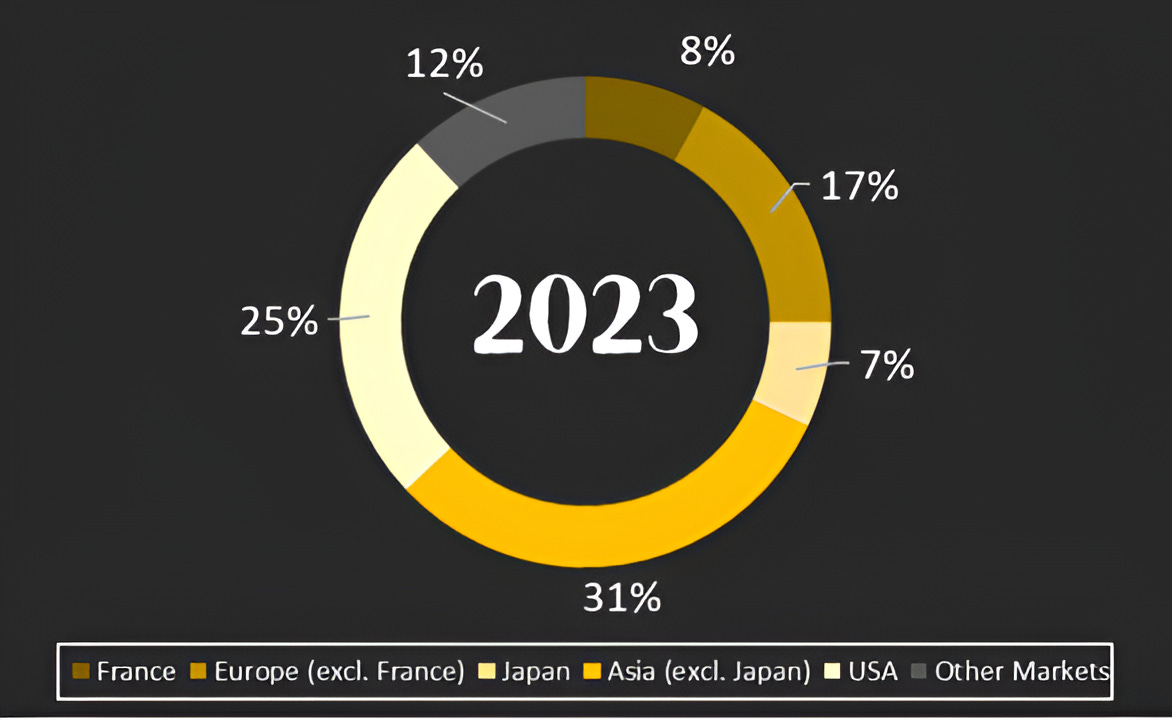

LVMH has a network of 6097 stores across 81 countries. The major markets can be divided into 6 regions — France, Rest of Europe, Japan, Rest of Asia, US & Other Markets. The largest contribution to total revenue came from Asia (31%).

Fashion & Leather business group was the highest contributor in each of these regions, except USA, where Selective Retailing & Other Activities business group was the largest contributor to the revenue.

Crafting Desirability: The Soul Of Luxury Industry

The world of luxury revolves around one key concept: Desirability.

LVMH CFO Jean-Jacques Guiony talks about the company’s priorities:

“Our top 3 priorities are, desirability, desirability and desirability. And this is not something that we change every other day. So we are focusing on increasing the desirability of our brands and all the strategies, the product, communication, distribution strategy we designed are aimed at increasing desirability.”

— LVMH Q3 2023 earnings call

So what exactly is Desirability?

Desirability is the measure of how much people want a product.

When a product truly achieves desirability—when it becomes an object of desire — it gains the power to defy the laws of traditional economics.

Let me explain. We’re all taught in school that when prices go up, demand typically falls. But in the luxury world, higher prices often have the opposite effect—they can actually increase demand. In this market, the more desirable a brand becomes, the more power it has to set its prices.

This is the magic of luxury. A brand that masters the art of crafting desirability can become a powerful profit machine.

But creating desirability is tricky. As LVMH CFO Jean-Jacques Guiony puts it:

“The debate, for me, is very much about making the brands accessible and at the same time, desirable. If we are very desirable and not accessible, we don't do any business. And if we are too accessible, it impacts the desirability, and we end up not doing any business anymore. So it's really about striking a balance at all times.”

— LVMH Q2 2018 earnings call

Luxury brands employ various strategies to engineer this desirability around their products. However, it’s a challenging task that only a few brands can achieve. But here’s something fascinating about desirability—it’s not just about attracting the ultra-wealthy, who are the primary customers for luxury brands. To be truly successful, a luxury brand needs everyone to desire its products, even those who can’t afford them.

Sounds counterintuitive, right?

Here’s why: when someone buys a luxury product, they’re not just buying a nice bag or a watch—they’re buying a status symbol. It’s like getting a VIP pass that says, "I’ve made it."

But for that status to carry weight, the brand must be widely recognized and admired.

Think of it this way: if you buy an expensive Louis Vuitton bag and nobody recognizes or cares about the brand, it loses its value as a status symbol. The magic happens when people across all income levels know and desire the brand, even if most can’t afford it.

It’s this universal appeal—the perception of the brand in people’s minds—that creates true desirability.

Can Desirability Be Crafted?

The desirability of a luxury product depends on six key factors:

Quality & Excellence – everything must be top-notch.

Heritage & Craftsmanship – the story and skill behind the product matter.

Exclusivity & Rarity – not everyone should have it.

Innovation & Modernity – staying relevant while honoring tradition.

Brand Identity & Recognition – having a strong, clear image.

Customer Experience & Personalization – making buyers feel unique and special.

When a luxury brand can master these factors, it can create desirability for its products.

Now let’s analyze how well LVMH is able to control these factors, & create desirability for its brands.

1. Quality & Excellence

LVMH brands are known for sourcing only the highest-quality raw materials, from the leather used in handbags, the silk in scarves, to the precious gemstones in high jewellery. In fact, they are among the few brands that continue to use real animal skin in their exotic leather products — such as crocodile skin, python skin, and ostrich skin — to ensure customers receive genuine, high-quality leather products.

In addition to sourcing, LVMH practices vertical integration by controlling key elements of the supply chain—from raw materials to finished products—to guarantee strict quality standards at every stage of production.

Louis Vuitton sources leather from its own tanneries, for direct oversight over leather quality

Moët & Chandon maintains control over the entire production process, from grape cultivation in its own vineyards to bottling. This ensures consistency in the taste and quality of its champagne

Guerlain, for instance, has its own orchidarium where orchids are grown to extract premium ingredients for their Orchidée Impériale creams.

Tiffany sources the majority of its diamonds and precious metals through direct relationships with known mines across the globe.

LVMH’s commitment to excellence extends to rigorous quality control. Every product, from handbags to high jewelry, is meticulously inspected for imperfections in texture, stitching, and overall craftsmanship. Louis Vuitton’s bags, for example, undergo extreme durability tests.

Louis Vuitton leather bags are also put through extreme tests, to ensure its durability. As Bernard Arnault, Chairman of LVMH, explained during the Q4 2021 earnings call:

“We try and ensure that when customer buys a sophisticated leather product from Vuitton or Dior that he really does get an outstanding product. At Louis Vuitton, we have machines of torture for all the leather goods.

If you like one day, maybe invite you to visit what remains of certain products of certain competitors when they emerge from the torture machines of Louis Vuitton. Sometimes there's not much left, whereas the Vuitton has to remain in the machine for a week before it can go to the stores.

That's the difference. It's really this focus on quality.“

2. Brand Heritage & Craftsmanship

Many LVMH brands were founded centuries ago, which gives them deep-rooted cultural significance. The rich heritage & unique craftsmanship which is passed down through generations increases the desirability of these products.

LVMH weaves a strong brand narrative that emphasizes these brands as symbols of tradition and history. By connecting modern products with their historical origins, LVMH creates an emotional bond with customers, making them feel part of a prestigious legacy. This heritage is a crucial component of the brand’s desirability.

Louis Vuitton: Founded in 1854, it began as a trunk maker in Paris, quickly gaining a reputation for high-quality craftsmanship. Louis Vuitton’s Asnières workshop has been producing custom-made trunks and leather goods by hand since 1859.

Chaumet, has a legacy as the jeweler to Napoléon Bonaparte. It has been crafting tiaras for European royalty for centuries, and today its artisans continue to create bespoke pieces in its Paris atelier, using traditional goldsmithing techniques.

Bvlgari, with its roots in Roman jewelry-making, continues to craft its high jewelry pieces by hand in its Italian ateliers, paying homage to ancient Roman craftsmanship traditions.

3. Exclusivity & Rarity

As most of LVMH’s product’s are handmade, it naturally limits the number of products that can be produced in a given timeframe. Sometimes, geographical constraints also exist like historic wineries in Champagne (a historical province in the northeast of France, best known for the production of champagne, the sparkling white wine that bears the region's name) can only produce a limited amount of wine at a time.

Additionally, LVMH creates artificial scarcity — limited editions, collaborations, and collectible products — to limit the number of items produced for certain collections.

Guerlain releases limited edition fragrances that celebrate unique themes or anniversaries, packaged in beautifully designed bottles that become collectibles.

Henessy collaborated with the fashion designer Kim Jones to created a 3D printed titanium casing that resembles the iconic shape of Hennessy X.O while evoking a couture silhouette reminiscent of a fashion garment.

Hublot collaborated with the tattoo artist Maxime Plescia-Buchi to create the Big Bang Sang Bleu series, that incorporate the intricate geometric designs characteristic of Plescia-Buchi's tattoo art.

By strategically combining these natural limits, geographical constraints & limited production, LVMH successfully cultivates an aura of rarity and exclusivity around its products. This exclusivity not only drives desirability, but also cements LVMH’s position as the leader in the luxury market

4. Innovation & Modernity

Though preserving heritage & craftsmanship is essential for a brand’s story, it is equally important to keep up with the evolving consumer preferences to stay relevant today.

LVMH tries to strike a balance between tradition and modernity by integrating tech into their products & creating innovative products to keep up with evolving consumer tastes.

The Tambour Horizon smartwatch combines traditional watchmaking with modern technology. This product reflects Louis Vuitton's ability to blend luxury with cutting-edge technology.

Tiffany & Co. ran "Not Your Mother's Tiffany" campaign to modernize the brand's image and appeal to a younger audience, specifically Gen Z.

Bvlgari’s Serpenti collection showcases innovative design appealing to contemporary tastes while maintaining a connection to the brand’s heritage.

5. Brand Identity & Recognition

A brand can’t always write its name on its products. So brands use the help of certain monograms, symbols & colours that tell people about the product’s brand & its exclusivity. As discussed earlier, this is crucial to create desirability.

How many of the brands were you able to guess, from the above images?

When you see the LV monogram on a leather bag, you can tell that the leather will be of the highest quality, made using excellent craftsmanship & will be extremely expensive.

The bee has been the emblem of Guerlain since 1853. It uses uses the bee emblem in its products extensively. One such example is the bee shaped perfume bottle.

Similarly, Tiffany’s has been using a specific blue known as Tiffany Blue in all of its packaging since 1845.

In the ancient Greek & Roman mythology, serpent was a symbol of wisdom, rebirth & vitality. Bvlgari uses the serpent motif extensively in its products to pay homage to its Roman roots.

When you see the FF logo on a bag or a dress, you can instantly relate it to Fendi.

Most of the brands in the LVMH portfolio have high brand recognition which increases its desirability.

6. Customer Experience & Personalization

The ultra wealthy people who buy luxury goods are already limited in numbers. Therefore, brands need to develop a long-term relationship with their customer to ensure they remain loyal to the brand.

LVMH brands use a combination of loyalty programs, VIP access & personalization to foster deep emotional connection with their customers.

Louis Vuitton offers bespoke monogramming on its leather goods, where customers can personalize their items with their initials and choose from a variety of colors and designs.

Moët & Chandon invites select customers to an exclusive VIP vineyard tour and tasting experience at its champagne estate in Épernay, enhancing their appreciation for the brand’s craftsmanship.

Krug offers message engraving & photo printing on its products. This service is especially popular for gifting and special occasions.

By combining innovative strategies with excellent execution, LVMH masterfully controls the six factors of desirability, driving high brand recognition and desire for its brands worldwide.

Organized Chaos: The Decentralized Structure Powering LVMH

Reflecting on his idea to put so many luxury brands — including those competing with each other — under one roof, Arnault told CNBC in 2018,

“In the 90s, I had the idea of a luxury group and at the time I was very much criticized for it. I remember people telling me it doesn’t make sense to put together so many brands. But it was a success … And for the last 10 years now, every competitor is trying to imitate, which is very rewarding for us. I think they are not successful but they try.”

How does LVMH manage so many brands under one roof, including direct competitors, without turning into a chaotic mess?

The credit goes to the unique decentralized structure Of LVMH.

At the top sits LVMH Moët Hennessy Louis Vuitton SE, the parent company. Bernard Arnault, chairman and CEO, is the strategic mind behind LVMH’s growth.

And as discussed earlier, LVMH has divided its operations into six business groups, each with a focus on a particular luxury sector. Each of these business groups has its own CEO.

Each brand (or maison) under a business group operates independently, and is led by its own CEO.

This autonomy allows each brand to maintain its unique identity, heritage, and creative direction. The CEOs of each maison reports to the CEO of its business group.

For example, CEOs of Louis Vuitton, Dior, Celine, etc. report to the CEO of the Fashion Group, Michael Burke.

This decentralized structure is the reason why brands under LVMH haven’t become monotonous & still maintain their unique identity & craftsmanship.

While creating desirability and maintaining its unique identity and craftsmanship may be enough for an independent brand, a publicly traded conglomerate like LVMH needs to keep growing to satisfy shareholders and maintain its market dominance.

LVMH’s Playbook for Growth: The Twin Engine Strategy

LVMH drives growth in two ways: organically, by scaling its existing brands and inorganically, through synergies created by strategic acquisitions.

Organic Growth: Scaling Brands

LVMH uses a combination of marketing & distribution strategies, to generate demand & scale its brands

Marketing Strategies

Brand Ambassadors

LVMH brands look for celebrities with a loyal audience that mirror the its target audience. These celebrities are appointed as their brand ambassadors, to serve as the face of the brand, embodying its value and image. This increases brand awareness and drive demand for its products.

Louis Vuitton appointed BTS, the popular K-pop group as their ambassadors to tap into their vast and dedicated fanbase, especially in Asia. This partnership increased the brand’s social media engagement by over 30% within a month, highlighting the direct impact of a well-chosen ambassadors on brand visibility.

This is the reason LVMH brands allocate a substantial portion of its marketing budgets to secure high-profile ambassadors.

Collaborations for Special or Limited-Edition Products

Content Marketing

Each LVMH brand invests in content that combines storytelling with luxury aesthetics, building a narrative around the brand.

In its youtube channel, Dior posts behind the scenes of its collections & the process behind making it.

Sponsorships

LVMH enhances brand visibility and prestige through event sponsorships, associating with luxury and high-profile gatherings.

Moët sponsors high-profile events like the Golden Globes and Formula 1, associating the brand with exclusivity and celebrations.

Distribution Strategies

LVMH’s distribution strategy is multi-dimensional, covering everything from flagship stores to e-commerce and selective retailing. Each approach ensures LVMH’s products are accessible to a specific segment of their target audience while maintaining the brands’ luxury status.

Flagship Stores & Boutiques

Louis Vuitton’s Flagships in Paris, New York, and Tokyo act as brand showcases, creating an immersive experience that celebrates Louis Vuitton’s heritage.

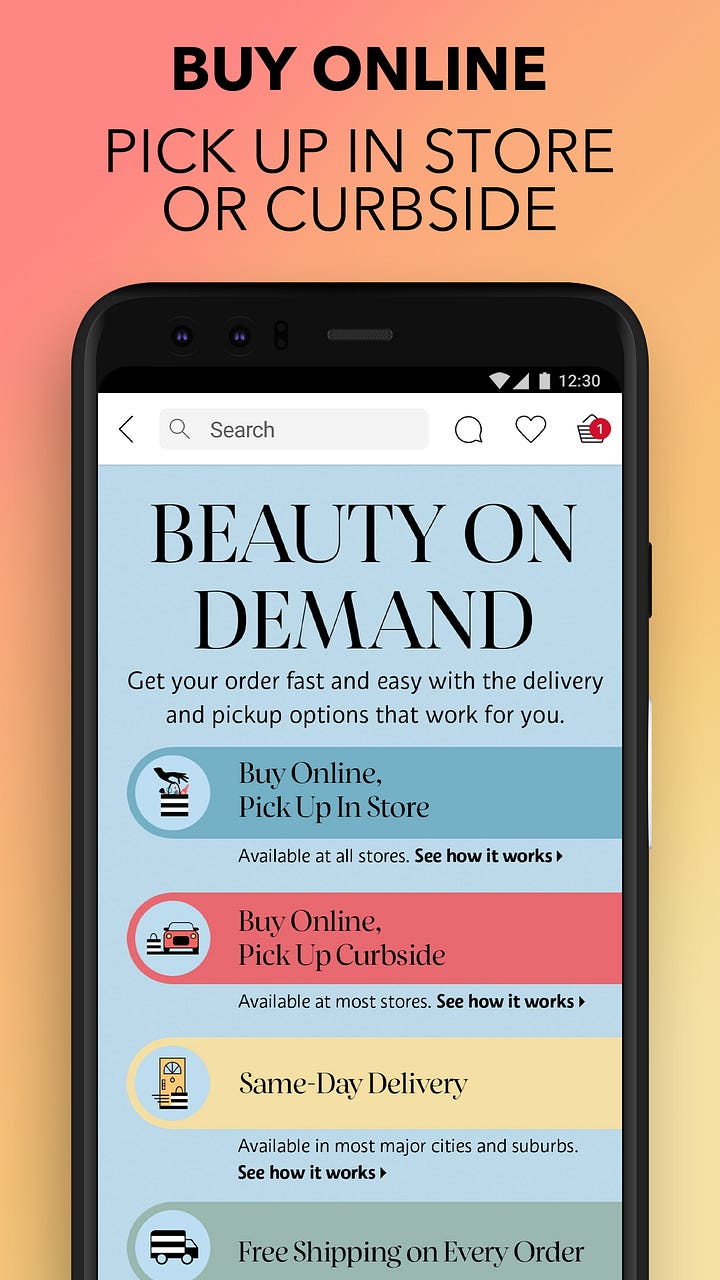

Omnichannel

Omnichannel, on the other hand, integrates both online and offline channels to create a unified customer experience. The omnichannel experience blends physical stores with digital platforms, using strategies like buy online, pick up in-store (BOPIS), reserve online, try in-store, and mobile point-of-sale systems to bridge the gap between digital and physical shopping. This approach focuses on customer convenience and engagement, making it possible to start a purchase on one channel and complete it on another.

Sephora’s Reserve Online, Pick Up In-Store service lets customers browse online and pick up products in-store.

E-Commerce

This focuses specifically on digital sales, with an emphasis on creating a seamless and luxurious online shopping experience. The e-commerce approach includes brand websites, apps, and digital marketing campaigns to attract and engage online shoppers. It’s primarily a digital-only strategy focused on reaching and converting customers through online platforms.

Louis Vuitton’s E-commerce Site replicates the boutique experience, with exclusive online collections and high-quality visuals. It also has a complimentary same-day, or next-day, delivery

Selective Retailing

LVMH brands also sell their products through certain luxury department stores, that have an atmosphere of elegance & sophistication.

Dior Beauty is available in luxury department stores like Saks Fifth Avenue and Harrods, enhancing brand prestige.

Geographic Expansion

LVMH continually taps into new markets, especially in regions with rising affluence like Asia and the Middle East, opening flagship stores and boutiques, to reach new customers. This regional expansion allows them to organically increase sales and visibility within high-potential markets.

Expanding into high-potential markets allows LVMH to capture new audiences.

Sephora has opened stores across China, South Korea, and Southeast Asia to capture the growing luxury beauty market.

Hennessy has introduced tasting rooms in China, where demand for cognac is high.

Moët & Chandon has entered emerging markets like India and Brazil, where luxury consumption is growing.

The Expanding Horizons: Entering Sports

Over the years, LVMH has mastered the art of staying relevant by reaching new audience.

LVMH began by collaborating with high-profile celebrities, synonymous with elegance, prestige, and exclusivity. This collaboration aimed at two things — tying the brand’s image with luxury & sophistication, and tapping into the artists' loyal fanbases.

As times changed and social media exploded, a new set of people emerged who commanded powerful followings and often connected with their followers on a deeper level — Influencers.

Though not directly associated with luxury and elegance, these influencers speak to niche audiences, whether they’re beauty junkies, fashion lovers, or wellness enthusiasts, bringing an authenticity that resonates with today's consumers.

Influencers are digital-first and often set trends. LVMH recognized that by working with them, it could connect with younger generations and stay ahead in the fast-paced world of social media.

So, celebrities and influencers are done... but what's next?

With a shrinking market of "aspirational" consumers — young, first-time luxury buyers — LVMH actively sought new opportunities to expand its horizons and found just the right one: the world of sports.

Recently, LVMH ventured into an unlikely arena — the 2024 Paris Olympics, becoming the first luxury brand to be an Olympic sponsor.

LVMH brands could be seen everywhere at the 2024 Paris Olympics: from Chaumet-designed medals and custom-made Louis Vuitton trunks for medal ceremonies, to French athletes wearing Berluti-designed outfits at the opening ceremony. Medal bearers wore vintage-style, distinctly French LVMH uniforms, and Moët champagne was poured to celebrate victories. LVMH was on full display at the 2024 Paris Olympic and Paralympic Games.

The company hopes that new potential buyers, will see athletes at the Olympics surrounded by LVMH brands and aspire to own these luxury items.

Moreover, LVMH has increasingly collaborated with athletes. But why athletes?

Athletes have a massive, loyal fan base across the globe, and they’re not just about games—they’re about lifestyle, camaraderie, and excitement. By partnering with them, LVMH aims to tap into this community of passionate, engaged fans.

Naomi Osaka was the first athlete to partner with Louis Vuitton, whose roster now includes Victor Wembanyama, Carlos Alcaraz, and many French Olympians and Paralympians.

In the influencer age, fashion has quickly embraced the sports world and elevated athletes as fashion tastemakers. These global stars help connect brands to a whole new market of fans and potential new buyers.

LVMH has looked to make a big splash in the sports world beyond the 2024 Olympics, by increasing its investments in sports through partnerships & sponsorships.

LVMH entered a 10yr partnership with Formula One to becomes its global sponsor, starting from the Melbourne Grand Prix in March 2025, bridging the worlds of motorsports and fashion.

Bernard Arnault’s holding company Financiere Agache has teamed up with energy drinks company Red Bull to buy a controlling stake in French soccer club Paris FC.

LVMH’s brilliant marketing & distribution strategies have enabled it to scale its brands and outperform its competitors.

But when we take a look at the luxury industry, LVMH doesn’t just perform better than its competitors, it skyrockets past them.

Consider this: LVMH boasts a market cap of $410 billion, while its closest rival, Hermès, stands at just half that with $232 billion. And If we look only at luxury conglomerates, LVMH's closest competitor, Richemont, comes in at a mere $84.2 billion.

Clearly, LVMH is more than just the sum of its brands. But what makes it so?

Inorganic Growth: Strategic Acquisitions

Itself born out of a Mergers and Acquisitions (M&A) deal, LVMH has been on a rampant shopping spree since the second year of the it’s establishment, making strategic acquisitions of star brands across different segments of the luxury industry.

Creating Synergies

When LVMH acquires and brings a luxury brands under its umbrella, it creates powerful synergies that help each brand operate more efficiently and grow faster than they could independently.

For those new to M&A terminology, synergy is when two merged companies create benefits greater than the sum of their individual parts.

Here's a simple example: If firm A is worth $500 million and firm B is worth $75 million, but together they're worth $625 million, that extra $50 million represents the synergy value of their merger.

Throughout the years, LVMH has mastered the art of strategic acquisitions, with the most recent one being the $16.8 billion Tiffany deal in 2020.

While Bernard Arnault is known for his aggressive acquisition strategy (including many hostile takeovers), and usually gets what he wants, there have been notable exceptions. The failed attempts to acquire Gucci and Hermès are corporate dramas that deserve their own spotlight.

But let's set those dramatic stories aside for now and focus on the wins – specifically, how LVMH's acquisitions create powerful synergies that benefit the entire group.

Global Distribution Network and Supply Chain Efficiency

LVMH has an extensive global distribution network that all its brands can use, which brings down costs and improves logistics efficiency. When Sephora opens in a new market, for example, it sets the stage for other brands under LVMH—like Benefit Cosmetics or Guerlain—to follow smoothly, without each brand needing to reinvent the wheel and build costly distribution networks independently in that region. This shared network means LVMH brands can reduce costs on things like shipping, warehousing, and retail operations.

Economies Of Scale In Sourcing & Marketing

LVMH buys materials like high-quality leather, glass for perfume bottles, and packaging materials in larger quantities. This creates economies of scale, meaning LVMH can negotiate better prices because it buys in bulk. This allows for reduced manufacturing costs as output increases. This efficiency can enhance profitability across its brands.LVMH uses its its size and brand portfolio to negotiate favorable rates for buying advertising space in bulk, which reduces the cost per unit of advertising and allows its brands to benefit from high-impact placements. advertising spaces in prime locations

Unified Marketing and Brand Positioning

While each brand maintains its unique identity, they all benefit from the overarching reputation of LVMH as a leader in luxury goods.

The high-profile “LV Dream” exhibition in Paris brought together elements from brands across the group, emphasizing their shared values in creativity and luxury.LVMH’s strong reputation gives it considerable influence with fashion editors, tastemakers, and major publications. LVMH leverages this influence, to ensure that its newer brands receive prominent media exposure and coverage in major fashion magazines and online publications. This is crucial for brand awareness and establishing credibility in the luxury sector. For instance, Rimowa benefited by being included in joint campaigns along with brands like Louis Vuitton and Dior, which amplified Rimowa’s luxury positioning, appealing to high-end consumers.

Leveraging Technology and Innovation

LVMH has an innovation center, where it works on digital solutions, sustainable materials, and retail tech. This setup allows LVMH brands to benefit from cutting-edge advancements without each one having to fund and develop them individually.For example, Sephora and Dior both utilize data analytics and AI tech developed by LVMH’s innovation team to better understand customer behavior and personalize shopping experiences online and in-store.

Financial Resilience and Strategic Support

By being part of LVMH, smaller or less profitable brands have financial backing and stability.For instance, when the pandemic hit, LVMH’s diversified portfolio meant that it could support brands with more physical retail presence, like DFS or Le Bon Marché, helping them survive in a challenging period. LVMH's financial strength enabled all its brands to stay on their feet and focus on long-term growth instead of just survival.

But successfully creating synergies is an extremely difficult task. Studies show that 70-80% of acquisition deals fail in creating synergies due to cultural clashes, integration difficulties, and overestimating potential benefits.

The fact that LVMH was able to successfully create synergies, that too consistently over the years, is a work of art in itself. And the credit for this goes to one man: Bernard Arnault.

Bernard Arnault & The Russian Dolls: Unravelling The Layers of Control

Bernard Arnault is a shrewd businessman, known for his ruthless business tactics and predatory acquisitions, which earned him the name The Wolf In Cashmere.

For a CEO in the luxury industry, Arnault had an unusual professional start: he began as an engineer and property developer in his family's civil engineering company in the industrial north of France.

The book ‘Taste Of Luxury’ covers the first half of Arnault’s life, from being born into a family running a construction business, to becoming the CEO of LVMH. I highly recommend reading this book.

(If reading a book sounds too daunting, you can listen to the 1 hr summary of this book on episode #296 of Founders podcast)

We’ll discuss the part that I found most interesting — the financial engineering techniques taught by his mentor Bernheim, which Arnault uses to this day to shape his empire.

Throughout his life, Bernard Arnault crossed paths with many key figures who played pivotal roles in his success, but none more prominent than his mentor Antoine Bernheim, an investment banker at Lazard.

What did Bernheim teach him? Instead of having the majority, that is 51% of thev capital in company A, it is better to have 51% in a purely financial company B, which itself holds 51% of company A.

One therefore also has control of company A by dividing the initial capital outlay. This reasoning can be continued infinitely.

Quote from The Taste Of Luxury

Instead of owning 51% of a company outright, Bernheim showed Arnault how to structure deals through holding companies, each controlling 51% of the next.

Bernard Arnault didn’t just learn this technique, he mastered it with Machiavellian precision.

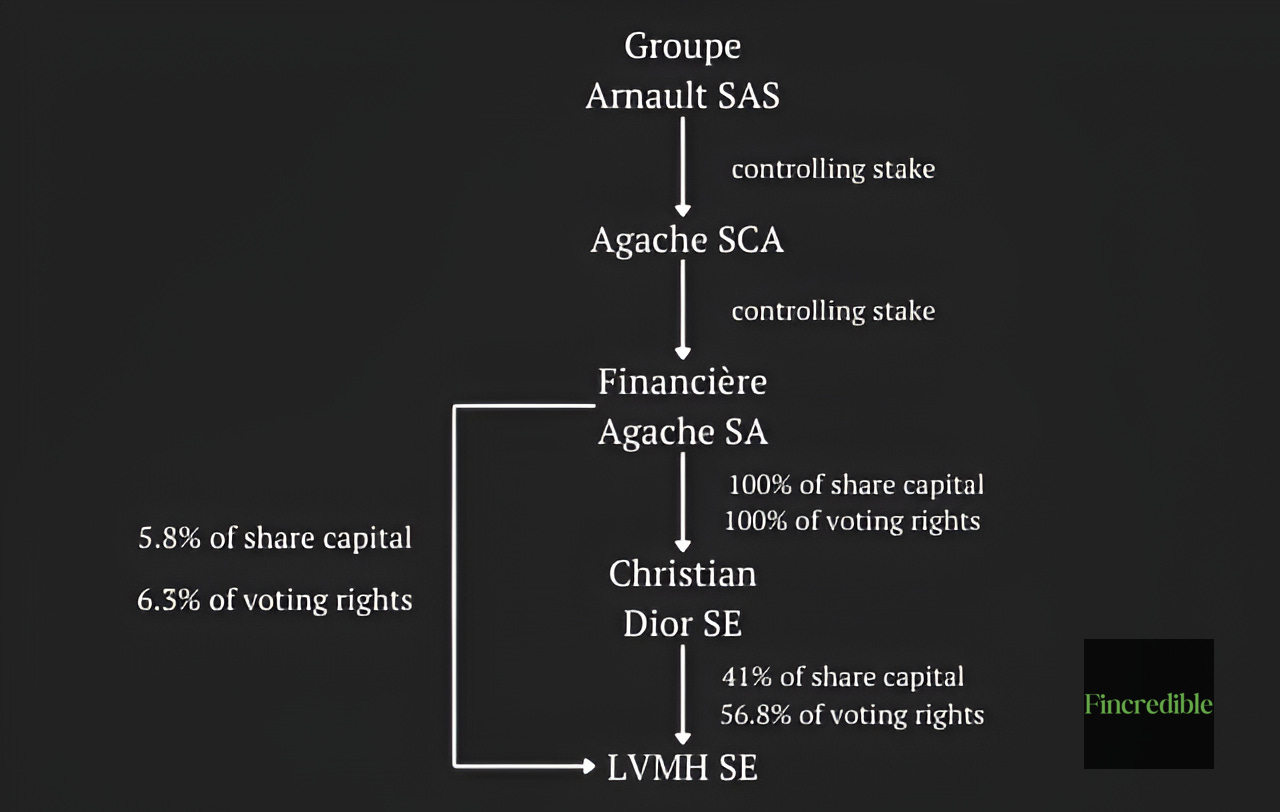

Arnault used this cascading structure— also known as “Russian dolls”— to control larger targets without initiating costly takeovers to buy 100% of the target company. This method allowed him to maintain control while deploying only a fraction of the capital he would have otherwise needed.

The brilliance of this layered structure lies in how Arnault orchestrates his acquisitions. Every time he needs capital to make an acquisition, he just sells off minority stake in one of his subsidiaries on the stock market to free up some cash, without losing overall control.

Using this structure, Arnault established multiple layers of companies.

At present, (an overly simplified version of) Bernard Arnault’s empire is structured something like this:

Groupe Arnault is a family office that manages the Arnault family's investments and philanthropic activities. The firm focuses on venture capital investments in tech companies, and has a diversified portfolio of over 41 investments.

Agache SCA is a limited partnership controlled by the Arnault family, with Bernard Arnault as its founder & Managing Director.

Financière Agache SA is a holding company controlled by the Agache company. It has a 100% stake in Christian Dior SE.

The Financière Agache group also holds a diversified portfolio of other financial investments.

Christian Dior SE is a separately listed holding company and has a controlling stake of 41% in LVMH.

Combining the investments made in LVMH through different layers of holding companies, the result is that the Arnault family group now controls 48.6% of LVMH’s capital and 63.5% of its voting rights.

Succession: Who Will Inherit the LVMH Throne?

Bernard is acutely aware that vulnerable generational transitions can make or break a family business. Divisiveness between relatives can often prove fatal. In his acquisition efforts, he has targeted these divisions in takeover battles with other family-run businesses. In fact, Bernard has weaponized fault lines in the succession planning at the companies and used their own family friction to his own advantage.

One case, however, was very close to his heart — the fall of the Lagardères. After the patriarch’s unexpected death, when his son Arnaud took over the media empire, the lack of an adequate succession plan became painfully obvious. The group fell into debt and was sold off in pieces by the son.

Arnault had a front seat to this unravelling, first as a close friend and tennis partner of the father, then as an investor in the family holding company as the son tried and ultimately failed to ward off a takeover by the corporate raider Vincent Bolloré.

The story of Lagardère is notorious among French business leaders. It is a cautionary tale of the importance of diligently preparing and putting succession plans into place – often before you think you really need them and before it’s too late.

In 2022, the 75-year-old chairman and CEO of LVMH, Bernard Arnault had his retirement age raised from 75 to 80, which should keep him at the helm of the $410 billion empire for another couple of years at least.

But there’s been much speculation over Arnault’s succession plan, as stakeholders worry about the company’s future once he retires.

Arnault had begun grooming all 5 of his children from an early age. Each child was assigned a mentor as they entered the business at one of its brands, and each started on the shop floor.

Currently, each of them are high-level executives at LVMH, with the oldest two having spent decades climbing the corporate ranks:

47-year-old Delphine is Chairperson and CEO of Christian Dior Couture, LVMH’s second-biggest brand. She previously served as Executive Vice President of its largest brand, Louis Vuitton. Delphine joined the LVMH Board of Directors in 2003, becoming the first woman and the youngest person to serve.

In January 2023 Antoine (age 45) was named CEO of Christian Dior SE and Vice Chairman of its Board of Directors. He has been on the LVMH Board of Directors since 2006.

Executive Vice President of Tiffany & Co, 30-year-old Alexandre is Bernard’s eldest child from his second marriage. Alexandre had previously been CEO of Rimowa after he persuaded his father to buy the German luggage brand in 2016.

28-year-old Frédéric has been CEO of Tag Heuer since 2020. Before that, he incrementally climbed the ranks at the Swiss watchmaker after joining LVMH full-time in 2017.

Jean (age 24) joined the family business in 2021. He is the Director of Marketing and Development in Louis Vuitton’s watch division.

Frédéric and Alexandre, were appointed to the LVMH board at the company’s annual general meeting (AGM) earlier in 2024.

Delphine Arnault and Antoine Arnault, were already on the board of directors, leaving Jean Arnault, the youngest, the only remaining sibling without a seat, although he is employed at the firm & is expected to join his siblings on the board soon.

Through a series of moves over the years, many of which have escaped public attention, Arnault has laid the groundwork he hopes will prevent divisions/ infighting in his own family empire. At the heart of the plan was the conversion of the main holding company, Agache, into a limited joint-stock partnership in 2022. The control of Agache will be exercised by its general partner (GP), Agache Commandite SAS, the share capital of which will be held equally between the five children.

This choice is not a coincidence, as the limited partnership is recognized for its characteristics facilitating the transmission within a family business. It allows to dissociate management and ownership of the capital and also constitutes a dissuasive weapon against hostile takeover bids. It can be found in some large groups such as the tire manufacturer Michelin, the luxury brand Hermès, or Sofibol, the holding company of the Bolloré group.

The new structure locks in ownership of the holding group, as shares in Agache Commandite cannot be sold or transferred for the next 30 years, unless decided unanimously by a five-person administration committee, which will initially consist of the five siblings.

“The new structure will permit to perpetuate the family control over the long term and will permit a unified expression of the controlling shareholder’s voice regarding Christian Dior SE and LVMH SE.”

— Agache announced in a statement at the time.

This is the vehicle the patriarch hopes will prevent divisions among his heirs and ensure LVMH remains under the control of Arnault family for decades to come.

The transition from one generation to the next is the most vulnerable period in the life of a family-controlled company. There are many uncertainities —

will the transition be smooth and free of conflict? Will the new CEO be able to fill Bernard Arnault's shoes and meet the high expectations? Will LVMH maintain its historic growth trajectory?

It will be interesting to watch this transition unfold as time reveals the fate of the world's largest luxury conglomerate — LVMH.

If you have any questions or want to share your thoughts, feel free to reach out in the comments 💬 below.

See you next time!