The Gamestop Shortsqueeze Saga

How some Reddit Rebels took on the Financial Titans fueling one of the wildest frenzies Wallstreet has ever seen

Hedge funds play a vital role in the financial system by providing price discovery and enhancing market liquidity.

In the cut-throat competitive landscape of Wall Street, hedge funds stand as apex predators.

Collectively managing a staggering $3.4 billion in assets, when these financial giants move in unison, they possess the power to sway entire markets, propelling companies to the heavens or driving them into the abyss.

For these financial giants, shorting stocks is a well-proven strategy, honed over more than a century. They are known to collaborate through various channels, from online forums to dinners and get-togethers, where they discuss investment ideas and trading strategies. And once they launch an attack on their target, they never retreat without squeezing every last dime from it.

But on January 21, something inexplicable began to unfold. They found themselves facing enormous losses on their GME shorts, and if this trend continued, they would all go bankrupt within a week.

A sense of unease gripped Wall Street, and panic spread like wildfire. Nothing like this had ever happened before.

Where All The GameStop Drama Began

In October 2018, something extraordinary began to take shape on a subreddit called 'wallstreetbets'. With roughly 300,000 members who referred to themselves as 'degenerates,' this platform became a hub for users to share their research and trading ideas. But what set it apart was its irreverent and sarcastic culture.

People weren't just here for serious discussions; they were drawn by the audacious bets on meme stocks, some bordering on the ridiculous. The allure lay in the sometimes jaw-dropping wins and losses that followed these daring moves, attracting a growing audience to this unconventional corner of the internet.

But the real GameStop saga took off in June 2019. GameStop, an American video game retailer listed on the New York Stock Exchange (NYSE) as "GME," found itself in troubled waters. A dismal earnings report and the decision to cancel dividend payments sent shockwaves through the market, resulting in a negative sentiment around the company. Wall Street analysts downgraded the stock, and this downturn caught the eye of hedge funds.

Seeing an opportunity, these hedge funds decided to heavily short GameStop, betting on its further decline. Meanwhile, over in wallstreetbets, Keith Gill, a member known by the username DeepF*****gValue made a significant move. He posted about his $50,000 investment in long-dated Jan 2021 Call Options of GameStop, backing his decision with a deep dive into the company's fundamentals. This decision was about to set the stage for one of the most astonishing financial showdowns in recent memory.

In August 2019, the GameStop story took another twist when Dr. Michael Burry, famous for shorting the subprime mortgage in 2008 financial crisis, made his move. He announced that he owned a significant 3% stake in GameStop, and gave compelling reasons to back his investment. He pointed out that a remarkable 90% of GameStop stores were generating positive free cash flow.

Simultaneously, on the vibrant wallstreetbets forum, Keith Gill continued to share monthly updates on his GameStop position, which had already surged by an impressive 92%.

Fast forward to March 2020,

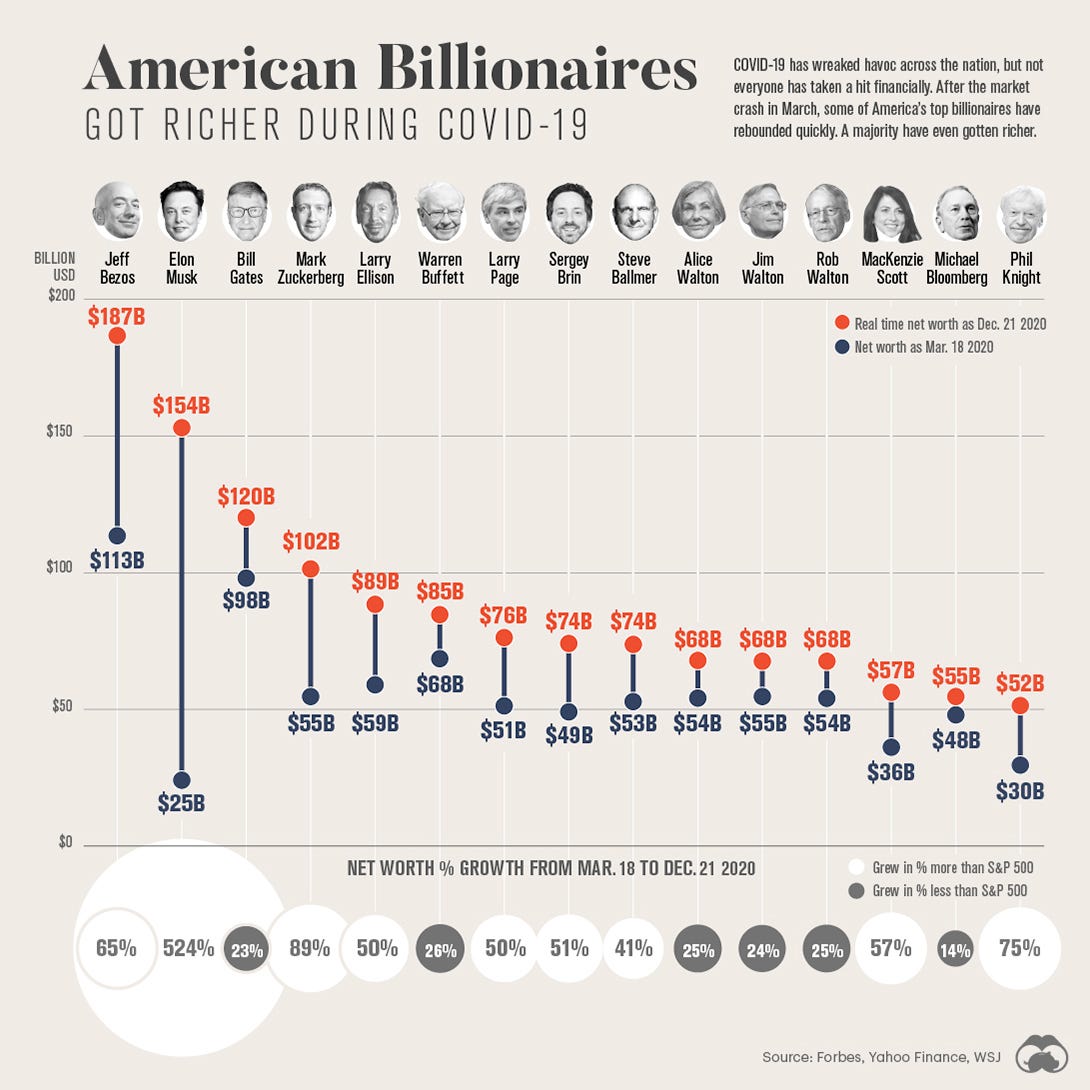

A global pandemic triggered lockdown around the world. In the United States, 47% of jobs come from small businesses, therefore imposing a lockdown caused economic turmoil. With people out of work & growing restlessness with their situation they started to notice something. While their jobs were gone & were businesses were shut down, massive corporations like Google, Microsoft, Facebook, Amazon & Walmart were thriving. Not only this, even the financial markets began to boom. The wealth was once again getting redistributed & the rich were getting richer.

Setting the Stage For A Showdown

In August 2020, GameStop reached a new low with its stock price at a mere $2.57. However, a glimmer of hope emerged when Ryan Cohen, co-founder of Chewy and a notable figure in Silicon Valley, acquired a significant 9% stake in GameStop. He joined the ranks of those who believed in GameStop's potential and were betting on its resurgence.

In September 2020, wallstreetbets continued to buzz with GameStop fervor. A member shared a detailed stock analysis of GameStop titled 'GME Short Squeeze, outlining the path to victory for GameStop. Here's an excerpt from that analysis:

'GME is one of the most shorted stocks: 55M of 65M shares are short, including >100% of float. Based on average volume, it would take over 15 days for all shorts to cover. More than half the shorts entered under $7 and are now taking losses. A price spike from good news could trigger a Short Squeeze and force shorts to cover at higher and higher prices. If only there was some good news…'

As we delve further into the GameStop saga, a pivotal moment arrived in January 2021. The strategy was clear: once some good news about GameStop broke out, the market would realize that GameStop wasn't as bad as it seemed. When this awakening occurred, stock prices would rise, compelling short-sellers to close their positions by buying GME stocks. As they bought, the prices would spike even more, forcing more shorts to exit - a phenomenon known as a Short Squeeze. All they could do for now was wait for that long-awaited good news.

Then came January 12, 2021, the day of the final showdown. Ryan Cohen, the investor who had acquired a 9% stake in GameStop, secured a seat on the Board of Directors. With his e-commerce expertise, Cohen was expected to orchestrate a GameStop turnaround. This news electrified the wallstreetbets community. They finally had the good news they'd been waiting for, and it was time to take action.

Let's take a moment to understand the key terms here.

Long Position

When you buy a stock, your maximum potential loss is what you initially invested, while the potential for gains is unlimited, depending on how high the stock soars. This is known as taking a Long Position.

Short Position

On the flip side, when you short a stock, your maximum potential gain is limited (usually if the stock hits $0), but your potential losses are infinite, rising with the stock's ascent. This is called taking a short position.

Reddit Rebels vs Wallstreet Titans: The Battle Begins

On one side of this battle were the big hedge funds and institutional investors, convinced that GameStop was headed for failure. They pushed the stock price down through short selling - they were known as Team Bear.

On the other side stood members of the wallstreetbets community, along with investors like Michael Burry and Ryan Cohen. They believed in GameStop's fundamentals and bet long on it, driving the price upwards. They were known as Team Bull.

Let's take a look at how the GameStop share price evolved during this period:

January 12, 2021: The GameStop(GME) share price was $19.95.

January 13, 2021: It surged to $31.40.

January 14, 2021: The price climbed to $39.91.

January 19, 2021: It settled at $39.36.

The short sellers started to feel the pressure, but many of them doubled down on their positions.

There were reports of Hedge Funds using a technique of Short Ladder Attack - selling hundred GME share increments, back-&-forth to each other in order to drop its price.

It became a matter of pride; they couldn't back down against a group of Reddit rebels.

Over the next few days, news of this financial war spread like wildfire. More and more people joined in. What began as a trading strategy for retail investors to make a quick profit had morphed into an all-out proxy war between the common man and Wall Street.

On January 22, 2021, the GameStop(GME) share price hit $65.01.

As the week came to a close, there were surprising new entrants to the battle. Quant funds and momentum hedge funds, who had been observing from the sidelines, decided to join the fray. It was an opportunity to eliminate some competition, so they joined Team Bull.

By January 25, 2021, the GameStop(GME) share price had soared to $76.79.

However, amidst all this chaos, one major hedge fund, Melvin Capital, which had heavily shorted GameStop, was teetering on the brink of collapse.

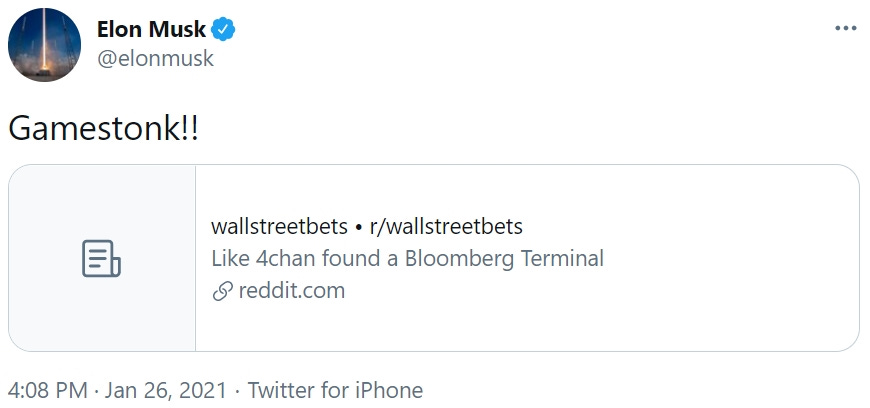

January 26, 2021, brought an unexpected twist when none other than Elon Musk chimed in. He tweeted - ‘Gamestonk!!’ along with a link to the wallstreetbets subreddit. This endorsement gave Team Bull a massive boost, and the GameStop stock price exploded.

By January 28, 2021, the GameStop(GME) share price had reached an all-time high of $483. This was nearly 18,698% of the low it had hit just nine months earlier in April 2020.

In the wallstreetbets community, Keith Gill, who had been sharing his monthly updates, saw his original $50,000 investment turn into a staggering $48 million.

Everything was going according to plan, and it seemed like the hedge funds could be put out of business if this continued.

The Fallout: How It all Came Crashing Down

Suddenly, everything started to fall apart.

The wallstreetbets Discord server was shut down citing hate speech, and brokerages like Robinhood restricted the buying of GameStop for 24 hours, although selling was still allowed. This restriction appeared to favor Wall Street.

Robinhood, a startup brokerage that had gained immense popularity with around 15 million active users due to its zero-commission model, was at the center of the storm. The GameStop(GME) share price plummeted to $193.60 during this period.

This temporary halt in buying gave the hedge funds a window to regroup, reposition, and exit the trade if they chose to.

Melvin Capital, a heavy short seller was a casualty & had to be bailed out for $2.6 Billion by Citadel, another hedge fund.

Later, Musk himself grilled Robinhood’s CEO Vlad Tenev on the sudden trading restrictions. Vlad’s justification was that when you buy a stock through their platform, they don't immediately execute your order but instead send it to a clearinghouse. This clearinghouse takes up to two days to transfer the shares to you. On the day of the trading restriction, the fees that Robinhood had to pay the clearinghouse skyrocketed to $3 billion, which was more than they could handle. As a startup that had raised only around $2 billion, paying this fee would have bankrupted them.

Other brokerages offered similar explanations, but online debates raged on whether the clearinghouse fees were legitimate or potentially influenced by Wall Street pressure.

The Aftermath

GameStop’s top 3 investors gained over $2 Billion in personal wealth. While other retail investors too gained some profit & used it on variety of things - from repaying student loans to healthcare & some others donated all their profits to their local charity.

The GameStop saga has set a precedent. The idea has since gone global, from Amsterdam to Sydney. In Tokyo, some of the most shorted stocks jumped 7% & in Europe, it jumped more than 20%.

Redditors noticed some other companies like Nokia & AMC, that were in bad shape were heavily shorted by the Hedge Funds. Other coordinated attacks took place to spike up their prices too & it worked.

The common man aligned with wallstreetbets, experienced one powerful realization: the power of unity.

Though Wall Street's power was immense, The people's unity was their defense. Remember, when underdogs unite and fight, Remarkable feats shine bright.

Additional Resources