What Killed Silicon Valley Bank?

This is the story of SVB's rise and fall—a cautionary tale of risk, greed, and unforeseen consequences.

In the high-stakes arena of banking, every decision is a strategic move on the chessboard of finance. SVB, a prominent player in this arena, embarked on a journey marked by bold decisions that initially propelled it to success. But as the saying goes, "The bigger they are, the harder they fall." Some of SVB's ambitious choices would soon come back to haunt them, sending shockwaves throughout the industry.

Narrowing Down in a Crowded Landscape

In a financial world teeming with established players and cutthroat competition, SVB set out to distinguish itself. It didn't want to be just another bank; it aspired to be exceptional. The key to achieving this was choosing a niche, and SVB's selection was nothing short of strategic genius. They set their sights on tech startups in Silicon Valley’s tech startups and their VCs (venture capitalists).

This decision was pivotal, propelling SVB into the uncharted waters of a "blue ocean"—a market untapped by its competitors. By focusing on a specific clientele, SVB carved a unique identity for itself, setting the stage for its rise.

Navigating the Financial Landscape

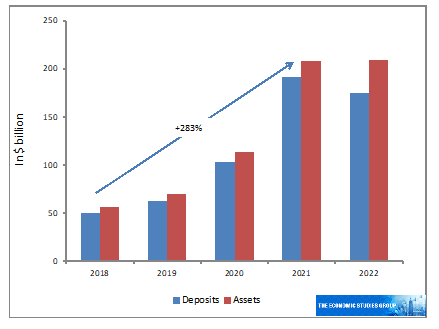

From 2019 to 2021, Silicon Valley was awash with cash, and with interest rates at historic lows, businesses thrived. SVB's deposits swelled from $61.76 billion to a staggering $189.20 billion.

Startups and VCs were already flush with cash and didn't require any more loans.

This posed a unique challenge for SVB - how should it earn from these massive deposits?

As SVB couldn't generate the desired yield on its capital through traditional lending, to maximize returns, it embarked on a bold path: They chose to invest most of their customer deposits ($80 billion) —into long-duration Mortgage-Backed Securities (MBS).

MBS (Mortgage Backed Security)

MBS is a type of asset-backed security which is secured by a mortgage or collection of mortgages.

The mortgages are aggregated and sold to a group of individuals that packages, the loans together into a security that investors can buy.

SVB's decision was strategic, driven by the desire to make the most of a low-interest-rate environment. Little did they know that this decision—or rather, the lack of one—would prove to be disastrous.

The Unraveling

SVB continued its rapid growth amid low-interest rates, & made it to the Forbes List of ‘America’s Best Banks’.

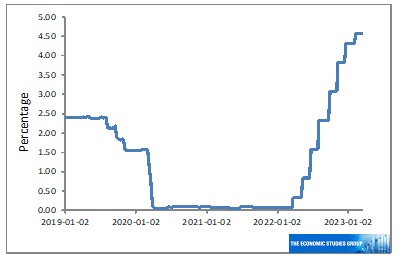

In response generous stimulus packages during the pandemic, the Federal Reserve, decided to increase interest rates to soak up excess credit in the economy.

As a result, it swiftly raised interest rates from 0% to 4.5% within a year. The repercussions were swift and brutal, and SVB found itself unprepared for it.

As interest rates soared, the MBS Silicon Valley Bank had invested lost substantial value and became illiquid. The once-thriving bank now faced a harsh reality—its assets were worth significantly less, and selling them would result in losses.

Interest Rates & Bond Prices

Bond prices and interest rates move in opposite directions, so when interest rates fall, the value of fixed income investments rises, and when interest rates go up, bond prices fall in value.

This happens because, now, investors find existing bonds less appealing. They are attracted to the treasury bills & newly issued bonds that offer much higher return.

SVB's startup clients too, faced the challenge of rising interest rates which resulted in reduced funding and led to cash burnouts. Deposits began to shrink, and SVB found itself trapped with insufficient liquid funds.

To mitigate a cash crunch, SVB was forced to sell $21 billion in assets, including the ill-fated MBS, at a loss of $1.8 billion.

The Fallout: It All Came Crashing Down

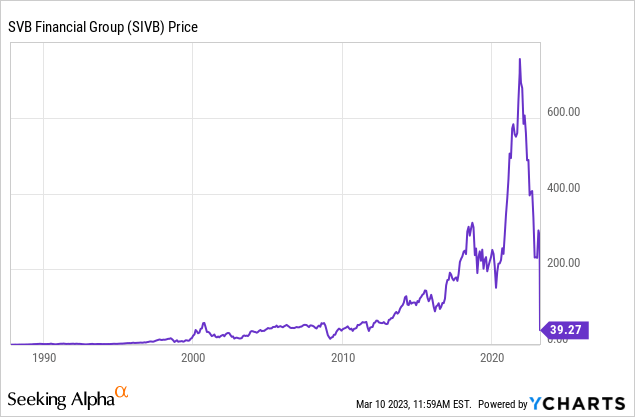

Further, they decided to raise capital of $2.25B to fill its funding hole, But failed Miserably. This failure made the headlines & SVB’s stock price started to tank.

With panic setting in, SVB's CEO, Greg Becker, held an emergency Zoom meeting, which, regrettably, only added fuel to the fire- as the meeting ended with the statement,

“ There is nothing for you to worry about. Unless everyone panics & takes out their money, in which case, you should be worried. “

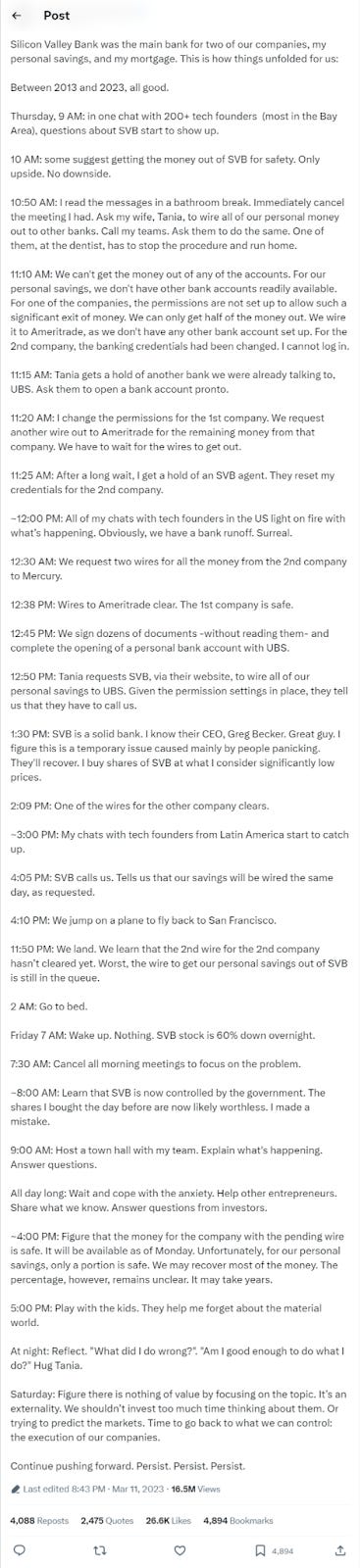

This was a huge blunder on his part as this triggered widespread panic within VC circles and founder chat groups. Investors, including prominent figures like Peter Thiel, advised portfolio companies to withdraw their funds from SVB, immediately, igniting a Bank Run.

Bank Run

A bank run is when the customers of a bank withdraw their deposits simultaneously over fears about the bank's solvency. As more people withdraw their funds, the probability of default increases, which, in turn, can cause more people to withdraw their deposits.

In a single day, a staggering $42 billion was drained from SVB, leading to them freezing customer accounts. This sent the SVB stock into a free fall.

SVB's once-stellar reputation lay in tatters.

Their only hope to get out of this mess is if some miracle happens & the Federal Reserve steps in & bails them out…

But that never happens.

Later, FDIC took control of SVB & released a statement that depositors would be protected & all of the insured money would be available, ending a nightmare week for Silicon Valley.

FDIC (Federal Deposit Insurance Corporation)

It was created after the Great Depression in 1933 to regulate a bank when one goes out of business & mostly to protect the bank’s customers.

The banks have to pay premium to FDIC & in exchange, this govt. insurance company insures the customers money & is meant to pay it back to customers if the bank collapses.

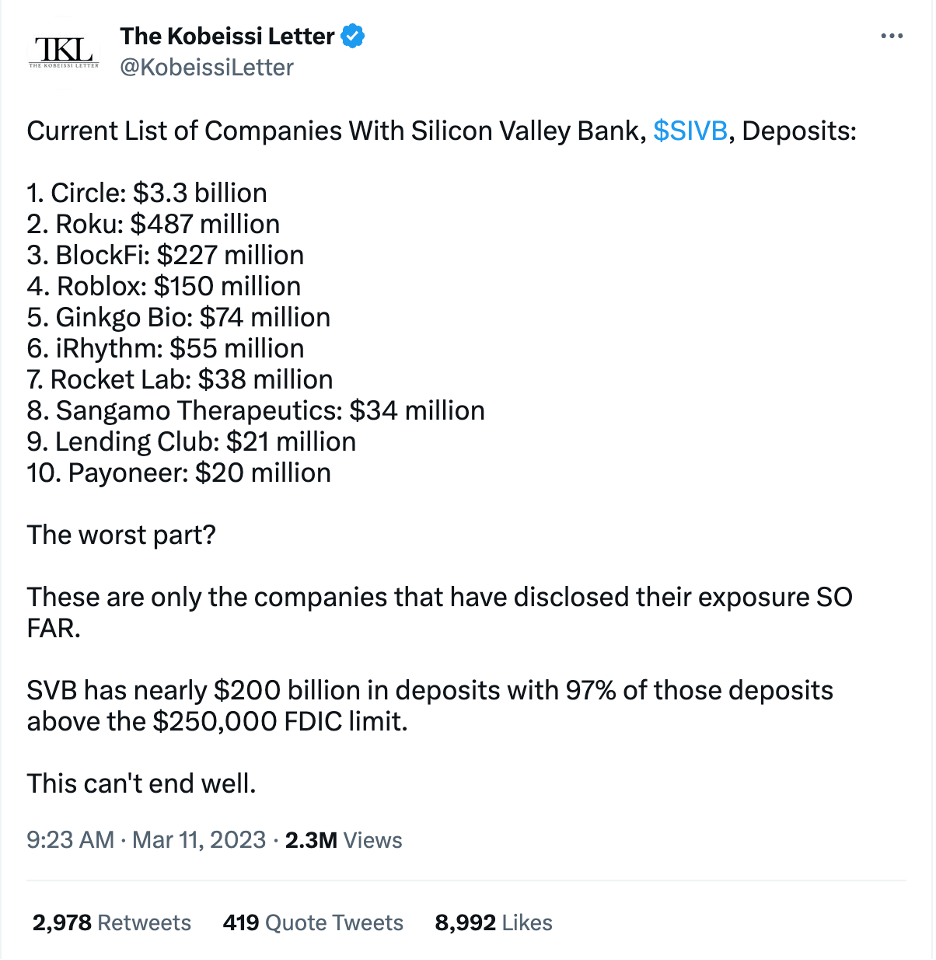

P.S : FDIC insures up to $250,000 for the customer

The Aftermath: A Stark Wake-Up Call

SVB's dramatic failure sent shockwaves throughout Silicon Valley.

While the FDIC offered insurance, it couldn't cover the immense deposits held by startups. As a result, many SVB customers were left without access to their savings, struggling to pay their employees & meet other financial obligations.

Moreover, SVB's exclusivity agreements (to keep all their accounts, including the personal ones with SVB) with startups bound them to the bank, complicating matters.

As a result, many startups out of business & pushed the thriving Silicon Valley landscape into a long & cold winter.

As a result, many startups went out of business pushing the once thriving Silicon Valley into a long and cold winter.

The aftermath also revealed troubling aspects of SVB's leadership, including suspicion of insider stock sales and the absence of a CRO (Chief Risk Officer).

Warning Signs: Where it All Went Wrong

Customer Concentration: While narrowing down its niche was initially a sound strategy, SVB's customer concentration within a single industry posed a significant risk. The fact that its customer base consisted primarily of interconnected companies within the same sector meant that any industry-specific downturn could put the bank at considerable risk.

Unfortunately, SVB had placed all its eggs in one basket, a decision that ultimately came back to haunt them.

Not Hedging Their Risks: In the relentless pursuit of profit maximization, businesses often prioritize revenue generation above all else. SVB was no exception. However, their downfall lay in their failure to adequately hedge against the inherent risks associated with their aggressive investment strategies. Ignoring these risks, as SVB did, proved to be a fatal oversight that contributed to their dramatic downfall.

Lack of a Chief Risk Officer: SVB's omission of a chief risk officer from their leadership team, whether due to oversight or cost-cutting measures, proved to be a costly mistake. A dedicated risk management expert could have potentially identified and mitigated the brewing financial storm before it wreaked havoc. In hindsight, the absence of this crucial position stands as a critical oversight that may have prevented SVB's catastrophic downfall.

SVB's dramatic rise and fall serve as a stark reminder of the perils of unchecked ambition, risky financial strategies & underscores the importance of prudent risk management.

SVB's story is a cautionary tale for the finance industry—a reminder that even giants can crumble when they overlook the fundamentals of Risk & Reward.