Have you ever wondered why, the moment something significant happens in the world—whether it's a macroeconomic shift or a geopolitical event—every news outlet and expert starts talking about crude oil?

What happens to oil if Israel attacks Iran?

What happens to oil prices if the Fed cuts rates?

What happens to oil prices if the rupee falls against the dollar?

What happens to oil if the Ever Given ship remains stuck in the Suez Canal for over a month?

I've had these questions lurking in my mind for quite some time, but crude oil as a subject always seemed too boring, so I kept postponing looking into it further. However, when reading about the recent geopolitical tensions in the Middle East and researching their impact on businesses, the economy, and the market, I once again found myself crossing paths with crude oil.

With escalating geopolitical tensions, It was time to stop procrastinating and & finally dive into the world of crude oil with one burning question:

Why does the entire global economy seem to revolve around oil?

This article is the result of my extensive research. If you've had the same questions about oil as I have, this article is for you. I aimed to fill the gaps I encountered while searching for answers, so you don’t have to waste hours trying to figure it all out. If you share or relate to this confusion, this article is exactly what you were looking for.

From Fuel to Fashion: Crude Oil Is Everywhere

Starting with the applications of crude oil seemed like the easiest place to begin this massive, intimidating task. So, that is where it all started.

I mean, I knew that crude oil is used as fuel, because when gas prices rise, my monthly budget takes a hit. And if it costs more for me to drive, it surely costs more to transport products from the factory to the stores—whether it’s groceries or electronics, right? That’s just basic economics.

But the more you think about it, the more you realize this price hike affects far more than just your car. Factories producing these goods rely on raw materials that are also transported, often from different parts of the world. If those costs rise, companies might pass them on to customers, meaning everything from your favorite cookies to the iPhone you’ve been saving up for, could become more expensive.

Makes you wonder: Could crude oil affect more than just transportation?

It turns out that crude oil isn’t just about fuel. Nearly everything around us can be traced back to it in some way.

It’s not just the fuel in your car but also the seats, tires, and even the bumpers—all made from oil derivatives. And the device you’re reading this on? Oil’s behind that too. From the synthetic fabrics like denim and nylon in your clothes to the plastic components in your electronics, oil plays a hidden role in our everyday lives.

Just exploring the applications of crude oil had opened up a Pandora’s box of a million new questions. And I still couldn’t wrap my head around how something as viscous, black, and smelly as crude oil, drilled from the depths of the Earth could be the foundation of so many things we use every day. How does this sticky liquid turn into everything nice around us?

But most of these questions were answered when I explored the value chain of crude oil.

So, let’s drill deeper into the value chain of crude oil.

Let’s Drill Deeper Into the World of Crude Oil

Exploration : Finding Oil Reserves

Crude oil doesn’t exactly sit around waiting to be found. It’s hidden deep beneath the Earth’s surface or the ocean floor, often in remote locations. Finding these hidden reserves is where the oil journey begins, and that’s where exploration teams come in.

Oil companies assign specialized exploration teams the task of finding these crude oil reserves. But where do they start, considering the search area has no bounds? Should they begin on land or at sea? Which country should they target?

Sometimes, the team gets lucky and spots an oil seep—basically, a natural oil leak where oil escapes through cracks in the ground or seafloor.

But other times, when they can’t find an oil seep, the team starts exploring areas with high potential to hold oil reserves, usually based on local geology and nearby petroleum deposits.

The team conducts land surveys to identify the most promising areas. Geologists in the team study rock formations and layers of sediment within the soil to determine if oil is present below. Once it’s determined that there are likely reserves beneath the ground, the team uses seismology to pinpoint the exact location of the reserve. Seismic waves interact with the oil reservoir, helping to identify its precise location.

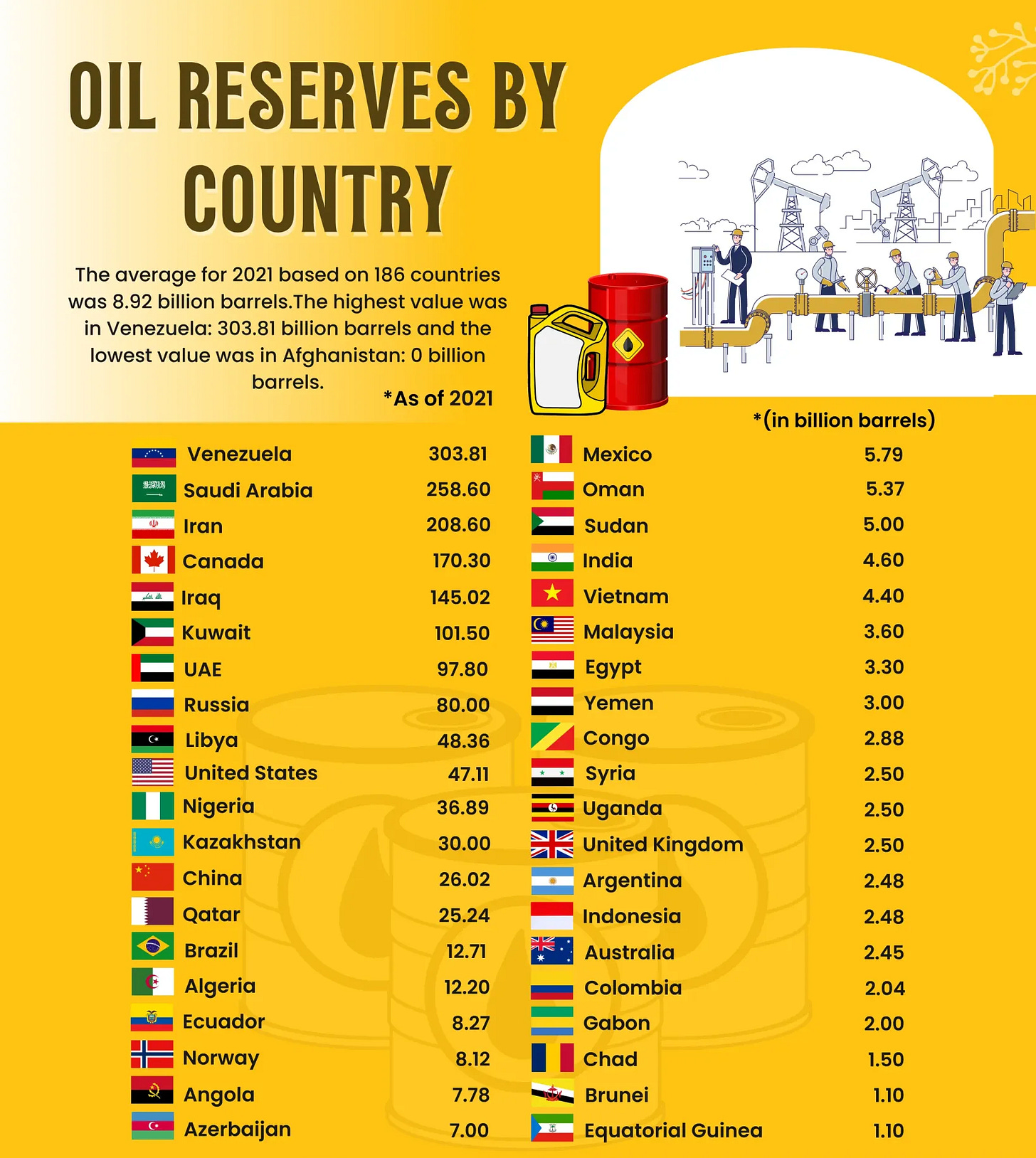

Who Has the Most Oil Reserves?

Production: Bringing The Oil To The Surface

If the reservoir has good quality oil in high quantity or volume, the engineers estimate how many wells will be needed, the best extraction method, and the project’s cost before sending it to the company for approval. Once approved, the team drills the wells and starts extracting oil. For this, a platform is constructed—a large structure with heavy machinery designed to drill wells and extract oil. This platform is what’s often referred to when you hear about oil rigs.

These rigs can be located on land (onshore) or in the sea (offshore), depending on where the oil reservoir is situated. Oil rigs are not permanent structures. Once the oil in a particular location is depleted, the rig is moved to a new site.

This exploration and production (E&P) phase is the first stage of the crude oil value chain and is known as the Upstream sector.

Who are the largest producers of Crude Oil?

Oil production is measured in barrels. One barrel (bbl) equals 42 U.S. gallons (or 159 litres approx). Companies often describe production in terms of barrels per day (bpd) or barrels per quarter.

The countries with the largest oil reserves aren’t necessarily the largest oil producers. Oil reserves indicate that proven oil reservoirs are present beneath the surface, but if a country isn’t extracting it, it won’t be a producer.

Saudi Arabia has the second-largest oil reserve and is also the second-largest producer.

Venezuela has the largest oil reserves, but due to political and economic conditions, it isn’t even in the top 10 producers.

United States has comparatively fewer reserves, but because it uses advanced technology to extract every drop of oil from its reserves, it’s the largest producer of oil.

Ever Heard Of US Shale Oil?

Shale oil refers to hydrocarbons trapped in shale rock formations that can be extracted for refining. Shale oil extraction has become viable thanks to horizontal drilling techniques and fracking, which allow oil and natural gas producers to efficiently extract resources from shale rock. Although shale oil has its uses, it is not a direct substitute for crude oil in many applications.

Furthermore, the extraction process of shale oil is much more capital-intensive, making it costlier than crude oil. Shale oil can be used to make gasoline, as well as other oil products like diesel fuel and liquid petroleum gas (LPG).

Transporting: Crude’s Travels The World

Once the oil is extracted, it’s stored temporarily. But crude oil in this form isn’t very useful because it’s a complex mixture of thousands of hydrocarbons. Think of crude oil as a weird thick soup of different hydrocarbon molecules, ranging from light hydrocarbons like methane (natural gas) to heavy residues like asphalt. Each of these hydrocarbon types has a different use, and to make them usable, we need to separate and sort them.

This separation and sorting of hydrocarbons, along with other processes, are done in specialized plants called refineries. But for that, first of all, this raw crude oil needs to be transported from oil wells located in various remote corners of the world to the refinery.

How Does Crude Oil Reach the Refinery?

Railway: When crude oil needs to be moved over shorter distances and pipelines aren’t present, railways are used.

For example, Union Pacific Railroad is a major U.S. railroad company that transports crude oil from fields in North Dakota and Texas to refineries along its network.

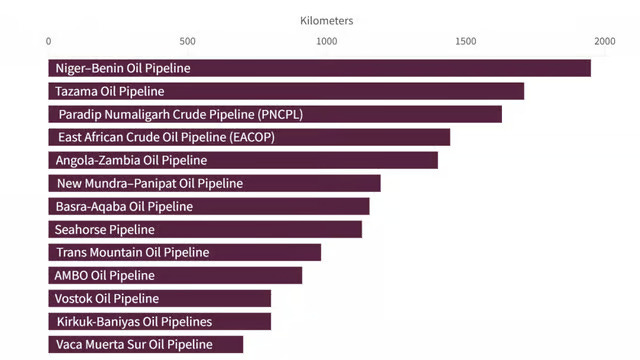

Pipeline: Pipelines are the most common and efficient method for transporting oil and gas over land. Once a pipeline is in place, it can continuously move large amounts of crude oil with minimal ongoing effort.

For example, the Druzhba pipeline transports crude oil from Russia to Europe, running approximately 4,000 kilometers and supplying several countries, including Germany and Poland. It is one of the longest pipelines in the world.

Tankers: When crude oil needs to be transported long distances across continents, it’s loaded onto tankers and moved via sea routes. The most common tankers are VLCCs (Very Large Crude Carriers), which can carry about two million barrels of oil.

For instance, Euronav’s VLCC often transport Iraqi crude oil to the Jamnagar refinery in India, one of the largest refineries in the world.

This transportation phase, from wells to refinery, is the second stage of the crude oil value chain and is known as the Midstream sector.

Refining: Where All The Magic Happens

As discussed earlier, crude oils are not uniform; they are mixtures of different hydrocarbons. To turn them into usable and valuable products, we need to separate and sort the identical or similar ones together. But how do we do that?

Converting this hydrocarbon mixture into usable products is done in a refinery through various complex processes. These processes vary depending on the type of crude oil—whether it’s light, heavy, sweet, or sour.

Here, let’s take a little detour to explore the types of crude oil & its benchmark. Then, then we’ll continue with refining.

Are all Crude Oils Same?

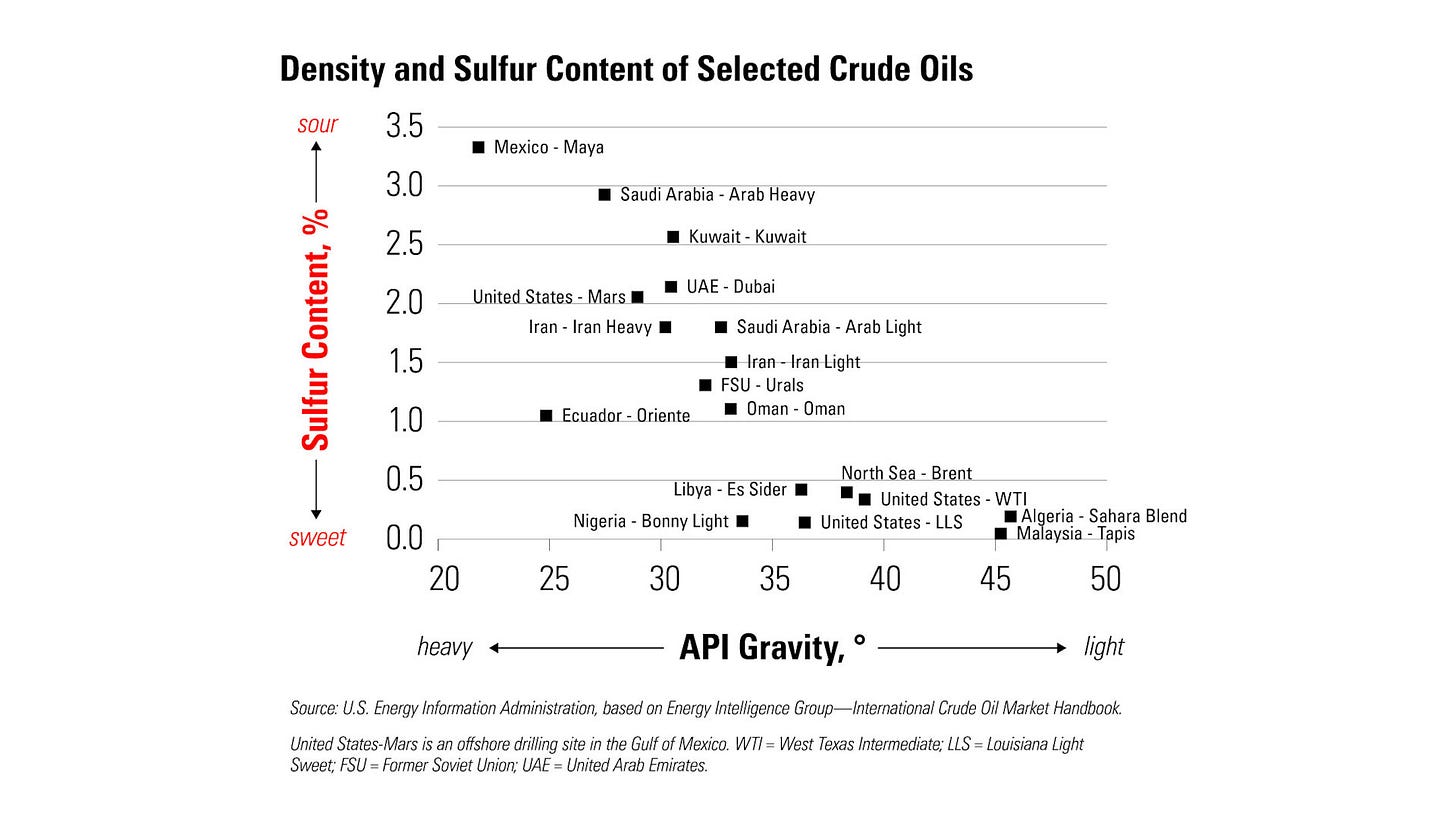

Crude oils come in various types—light, heavy, sweet, and sour. The differences boil down to three main qualities: density, sweetness, and TAN (Total Acid Number) count.

Density: Measured in API gravity, density determines how heavy the oil is.

Heavy Oil: Evaporates slowly and is primarily used to make heavy products like asphalt.

Light Oil: Requires less processing and yields a higher percentage of gasoline and diesel compared to heavy oil.

Sweetness: This refers to the sulfur content in the oil.

Sweet Crude: Contains very low levels of sulfur, well under 1%.

Sour Crude: Contains higher sulfur levels, around 1-2%, and requires additional processing to remove the sulfur.

TAN (Total Acid Number): This measures the corrosiveness of the oil. High TAN oils necessitate the use of higher-quality metals in pipelines and facilities to handle the corrosive nature and maintain integrity.

Assay: So Which One Is The Ideal Crude Oil?

Before processing, companies conduct an assay—a comprehensive chemical analysis of a barrel of oil. The ideal oil is light and sweet with a low TAN count, making it easier and cheaper to process. In contrast, heavy and sour oils are more challenging and costly to refine.

Benchmark Crude Oils

With over a hundred different crude oils traded globally, they’re typically labeled based on their region of origin. These labels serve as benchmarks for pricing and trading in the global oil market. The three most well-known benchmarks are:

West Texas Intermediate (WTI) - USA (Primarily Texas)

API Gravity: Approx. 39.6°

Sulfur Content: Low (sweet crude)

Viscosity: Light and easy to refine

Significance:

Serves as a pricing benchmark for North American oil prices.

Preferred for refining into gasoline and diesel.

Traded on the New York Mercantile Exchange (NYMEX).

Brent Crude - North Sea (Primarily the Brent Oil Field)

API Gravity: Approx. 38°

Sulfur Content: Low (sweet crude)

Viscosity: Light and easy to refine

Significance:

Primary benchmark for oil prices in Europe, Africa, and the Middle East.

Preferred for refining into gasoline and diesel.

Traded on the Intercontinental Exchange (ICE).

Influences global oil prices significantly due to its extensive use as a benchmark.

Dubai Crude - United Arab Emirates (Primarily Dubai)

API Gravity: Approx. 31°

Sulfur Content: Higher (sour crude)

Viscosity: Heavier compared to WTI and Brent

Significance:

Serves as a benchmark for oil prices in the Asia-Pacific region.

Commonly used for producing heating oil, diesel, and other middle distillates.

Provides pricing benchmarks for Middle Eastern and Asian crude oils. (Insert image of oil reserves by country)

The Refining Process: Separation, Conversion & Treatment

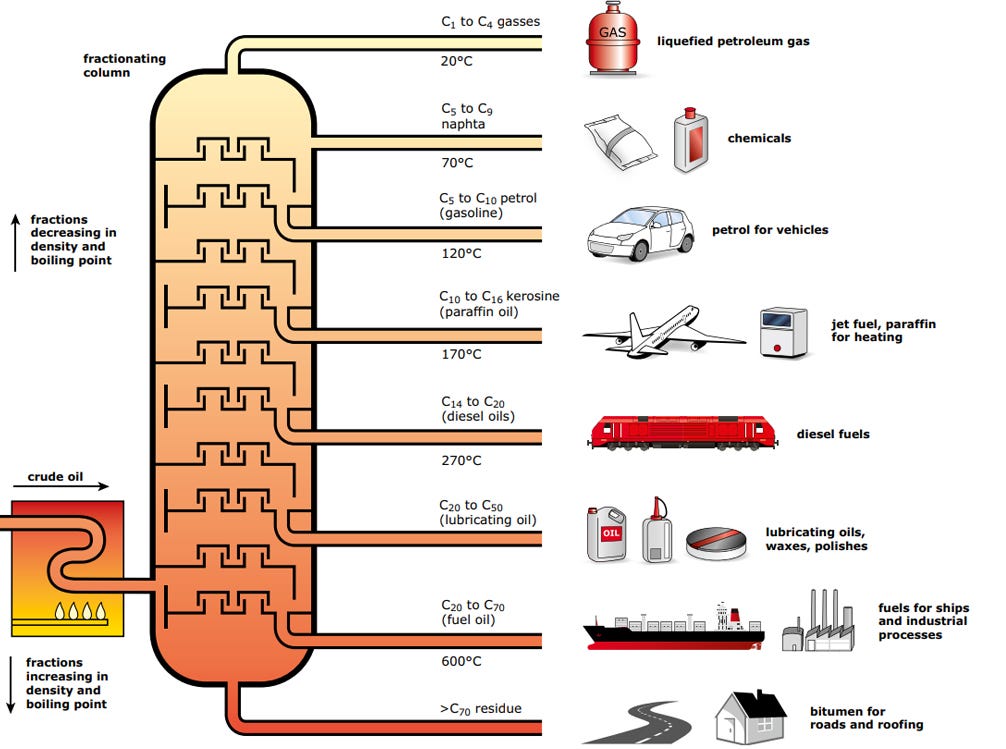

Now, let’s continue with refining. Every refinery follows three basic processes to turn crude oil into usable products: Separation, Conversion, and Treatment.

Separation

The first step is distillation, where crude oil is heated to separate its various hydrocarbons based on their boiling points.

Heating: Raw crude oil is pumped from storage tanks into a preheater and heated to temperatures between 350°C to 400°C.

Distillation Tower: The heated oil enters the distillation tower, where vaporization occurs.

Top of the Tower: Lightest fractions like methane, ethane, propane, and butane rise to the top and are extracted.

Intermediate Trays: Medium fractions such as naphtha, kerosene, and diesel condense at these levels and are collected.

Bottom of the Tower: Heaviest fractions like heavy fuel oil and residuum remain at the bottom for further processing.

Further Processing: These separated hydrocarbon fraction either serve as a feedstock for different products or sent for further refining.

Conversion

While lighter fractions can be used directly as fuels, heavier ones often require conversion to become more valuable. The primary conversion process is cracking, which breaks down large, heavy hydrocarbon molecules into smaller, lighter ones. This maximizes the yield of high-demand products like gasoline and diesel from crude oil.

Think of the heavier fractions of crude oil as a long chain, all linked together. While the whole chain might be too bulky or rigid to be useful, if you break it down into smaller sections, each shorter chain can be used for different tasks.

In the same way, cracking takes those long, heavy hydrocarbon chains and "snips" them into smaller, more flexible pieces, like shorter chains. These smaller pieces are what we need to create high-demand products like gasoline and diesel, turning a bulky, less useful material into something much more valuable and efficient!

Treatment

After separation and conversion, the hydrocarbon fractions still contain impurities such as sulfur, nitrogen, and metals. Treatment processes like hydrotreating and desulfurization remove these contaminants to meet environmental standards and performance specifications.

How Crude Oil Makes Everything Around Us

Remember the various uses of crude oil we discussed earlier—car tires, synthetic fabrics like denim and nylon, paints, medicines like aspirin—all of these are made using the lighter fractions of crude oil. Naphtha and light gases like propane, butane, methane, and ethane serve as primary feedstocks for petrochemicals such as propylene, ethylene, butadiene, and benzene. These petrochemicals undergo further reactions like polymerization to create a wide range of products:

Ethylene → Polyethylene (PE): Used in packaging, containers, and plastic bags.

Propylene → Polypropylene (PP): Utilized in automotive parts, textiles, and consumer goods.

Butadiene → Synthetic Rubber (e.g., Styrene-Butadiene Rubber, SBR): Employed in tires, footwear, and various rubber products.

These building blocks are behind everything from the denim in your jeans to bullet-proof jackets, from nail polish to the paint on your walls, from your car tires to your running shoes, and even your smartphone case.

Marketing: Delivering Refined Products To The Consumer

After refining, the next step is marketing and distribution. Refined products need to reach businesses, governments, and wholesalers efficiently.

This Refining & Marketing of crude oil is the third and final part of the crude oil value chain, known as the Downstream sector.

Crude Oil Prices: The Pulse of the Global Economy

It's no wonder crude oil commands so much attention—the world is heavily reliant on it. Everything around us is directly or indirectly derived from oil.

When oil prices rise, the economic growth of countries can be hampered, making oil prices a important topic in the news.

But, What Influences Crude Oil Prices?

Crude oil is traded not in stores like everything else, but through futures contracts. And the price of crude is set in the futures market based on the forces of supply and demand. Some key factors that influence crude oil prices:

1. Supply

Organization of the Petroleum Exporting Countries (OPEC) The Organization of the Petroleum Exporting Countries (OPEC) is a group of 12 of the world’s major oil-exporting nations - Algeria, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates, and Venezuela.

OPEC, along with other oil-producing nations (known as OPEC+), is one of the most influential groups in determining oil prices. OPEC controls around 40% of the world's oil production, and around 79% of the world’s oil reserves and its decisions on production quotas have a significant impact on global oil supply.

Shale oil, especially in the U.S., has transformed the global oil supply landscape. U.S. shale production can ramp up quickly compared to traditional oil wells, meaning U.S. producers can respond to higher prices by rapidly increasing supply.

2. Demand

Strong Economic Growth and industrial production boosts the demand for oil. Other important factors that affect demand for oil include transportation (both commercial and personal), population growth, and seasonal changes. For instance, oil use increases during summer sue to busy travel seasons and in the winters, as more heating fuel is consumed.

3. Speculators

Speculator is someone who is just guessing the price direction and has no intention of actually buying the product. Speculators use futures & options in hopes to profit from the price fluctuations in crude oil.

The majority of futures trading done by speculators whereby the purchaser of a futures contract takes possession (like businesses say airline companies) of the commodity is less than 3%. when there is a risk of potential price increase in future, speculators start buying crude oil futures to profit from it, driving up prices almost like a self-fulfilling prophecy.

4. Media & Market Sentiment

Media reports on production figures, spare capacity and investment can all affect people’s perception of supply risk, which makes the market sentiment & can impact crude oil prices in the short term.

Some of the most closely followed reports are OPEC's monthly oil report, the International Energy Agency (IEA) oil market report, and weekly inventory data from both the U.S. Energy Information Administration (EIA) and the American Petroleum Institute (API).

5. Petrodollar System

US dollars are the sole currency accepted by oil-exporting countries as a result of deals between US & Saudi Arabia. As a result, fluctuation in USD can influence oil prices globally.

But, Why does the entire global economy seem to revolve around oil?

Finally, let’s get to the most exciting part. We’ll dive into some recent geopolitical and macroeconomic events & see how they impacted crude oil prices.

Iran-Israel Tension → Rise in Crude Oil Prices

When Iran launched missile strikes on Israel, global concerns about Israel's potential retaliation increased. Since oil is a key source of income for Iran, an Israeli attack on Iran’s oil assets is highly likely. But any impact on Iran’s oil production or export facilities could disrupt supply by over 3 million barrels per day.

This could spike crude oil prices in the short term. Although, in the long term it may not have a major impact on global markets as members of OPEC+ and allied producers have enough oil reserves.

Meanwhile, In the Red Sea, another Iran-backed group, the Houthis in Yemen launch frequent attacks on international shipping. In case of an escalation, the Houthi rebels and Iraqi paramilitaries, might launch attacks on Middle East oil producers, like Saudi Arabia.

This fear & uncertainty drove up crude oil prices by almost 9%.

U.S. Federal Reserve Cuts Interest Rates → Rise in Crude Oil Prices

When the Fed cuts interest rates, borrowing costs decrease, stimulating economic growth. This leads to higher oil consumption as industries expand and transportation needs rise. Moreover, a rate cut often weakens the U.S. dollar, as lower rates make holding dollars less attractive to investors. So investors start to sell off their dollars in the foreign exchange (FX) mkt, increasing the supply of dollar. This decreases the value of dollar.

Since crude oil is priced in dollars globally, a weaker dollar makes oil cheaper for buyers using other currencies (countries like India & China), which can increase demand for oil.

As a result, both increased demand and currency effects contribute to a rise in crude oil prices following a U.S. interest rate cut.

Weak Rupee → Crude Oil Becomes Expensive for India

Recently, foreign investors sold over Rs 62,000 crore in the cash segment of Indian markets since the start of October 2024.

What did the foreign investors do with this cash? They converted it to dollars (by buying selling rupees & buying dollars). This large-scale outflow of foreign funds increased the supply of rupee in the mkt. As a result, rupee fell below its all-time low of 84.12. But RBI quickly intervened, selling dollars from its foreign reserve & buying rupee. This balanced out the the demand for the U.S. dollar, stabilizing rupee.

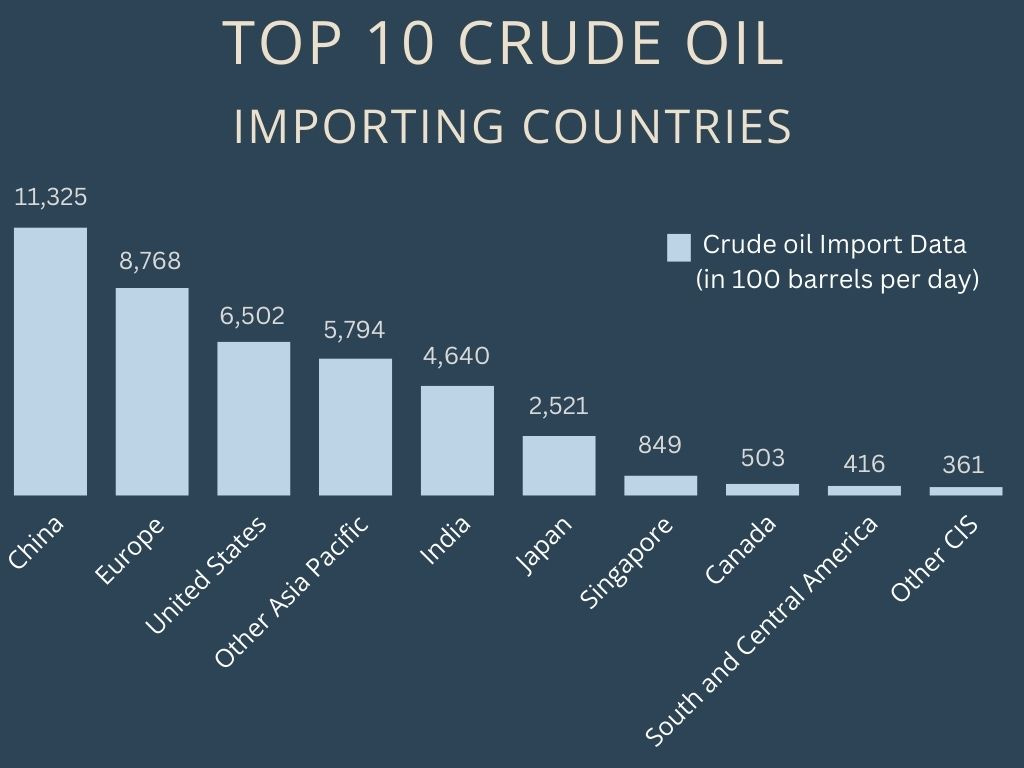

Moreover, India imports more than 85% of its domestic crude oil requirement. As a result of this heavy dependence on crude oil imports, any fluctuations in global oil prices can significantly impact the rupee. When oil prices rise, India has to spend more dollars to import oil, increasing the demand for the U.S. dollar and putting pressure on the rupee to depreciate.

And a weak rupee makes buying crude oil expensive for India.

Therefore, the relationship of Rupee with crude oil prices is complex & interdependent.

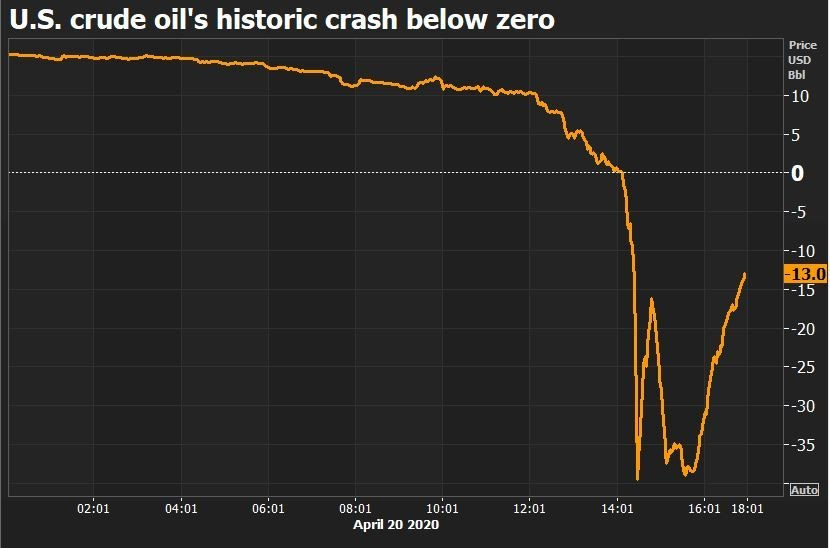

COVID-19 Lockdown in 2020 → Negative Oil Prices

During the COVID-19 lockdown, economic activities came to a near halt. This included low transportation activities (air travel, commuting, and freight), leading to a drop in oil demand. As a result, oil storage facilities were filled up, almost to full capacity with oil inventory (unsold crude oil barrels).

But on the other hand, oil Producers were unable to quickly adjust their output due to contractual obligations and logistical challenges. So Despite the drop in demand, oil production continued at high levels initially.

As the expiry of May futures of crude oil neared, traders who had bought crude oil futures previously, started selling off their oil futures as they were out of storage space to take physical delivery of new shipment of crude barrels. The sell off was so strong that WTI crude oil futures dropped to -$37.63 per barrel. This meant people were ready to pay anyone who agreed to take delivery of these oil barrels.

Ever Given Stuck in the Suez Canal → Increase in Oil Prices

A 400-meter container ship Ever Given, which is basically a ship the size of a skyscraper, got stuck in the Suez Canal in late March 2021 and remained stuck sideways in the narrowest path of the canal, leaving other ships and tankers—both north and south-bound—unable to pass. This quickly caused a buildup of vessels waiting to pass through, creating a traffic jam in one of the world’s busiest maritime routes, handling some 9% of seaborne traded crude oil.

The top three exporters of crude oil and oil products via the Suez Canal in 2021 were Russia with 546,000 barrels bpd, Saudi Arabia with 410,000 bpd, and Iraq with 400,000 bpd & the top three importers were India with 490,000 bpd, China with 420,000 bpd, and South Korea with 380,000 bpd.

Oil prices jumped almost immediately and continued climbing as the authorities said it could take weeks and even months to dislodge the Ever Given from the canal. Luckily, it did not come to months but the situation did affect about 13 million barrels of crude on 10 tankers stuck in that traffic jam.

The aim of discussing these events was just to give you an idea on how to think about such events & enable you to analyze its impact on crude oil prices.

I hope this read gave you a better understanding of the world of crude oil. I highly encourage you to continue your own research from here in the aspects of crude oil that interested you the most.

Enjoyed this edition? show some love by hitting the ❤️ button.

If you have any questions or want to share your thoughts, feel free to reach out in the comments 💬 below.

See you next time!